Market sentiment refers to the overall state of mind of investors toward a specific instrument or financial market. It is the overall tone of a market or specific instrument revealed through the activity and price movement. In general terms, rising prices indicate bullish market sentiment, while falling prices indicate a bearish market sentiment.

NOTES ABOUT MARKET SENTIMENT

- Market sentiment relates to the overall consensus about an instrument or the financial market as a whole.

- With rising prices, market sentiment is considered bullish.

- With falling prices, market sentiment is considered bearish.

- Technical indicators such as [PoshTrader] Market Sentiment help investors to measure market sentiment.

Understanding Market Sentiment

Market sentiment, additionally described as “investor sentiment,” is not always based on fundamental information. Technical analysts and Day Traders rely on market sentiment. It affects the technical indicators they use to measure and profit from short-term price movements often caused by investor biases toward an instrument. Market sentiment is also important to investors who like to trade in the opposite direction of the consensus. For example, if everyone is buying, one would sell.

Investors define market sentiment as bullish or bearish. When bulls are in control, instrument prices are going up. When bears are in charge, instrument prices are going down. Emotion often drives the financial market, so the market sentiment is not always compatible with the fundamental conditions.

Indicators to measure Market Sentiment

Some investors profit by trading instruments that are overbought or oversold based on market sentiment. They use different technical indicators to measure market sentiment that helps determine the best instruments to trade on financial markets. Popular sentiment indicators include the Bullish Percent Index (BPI), High-Low Index, Moving Averages, and PoshTrader Market Sentiment Indicator.

Bullish Percent Index (BPI)

The BPI measures the number of instruments with bullish patterns based on point and figure charts. Neutral markets have a bullish percentage of around 50%. When the BPI provides a reading of 80% or higher, market sentiment is considered optimistic, with instruments likely overbought. Furthermore, when it measures 20% or below, market sentiment is negative and shows an oversold market.

High-Low Index

The high-low index examines the number of instruments making 52-week highs to the number of instruments making 52-week lows. When the index is below 30, prices are trading close to their lows, and investors have a bearish market sentiment. When the index is above 70, prices are trading near their highs, and investors have a bullish market sentiment. This method is a widely used trading underlying index, such as the S&P 500 and Nasdaq 100.

Moving Averages

Investors use the 50-day SMA (simple moving average) and 200-day SMA when determining market sentiment.

There are two basic scenarios:

- The Golder Cross: the 50-day SMA crosses above the 200-day SMA, indicating that momentum has shifted to the upside, creating bullish sentiment.

- The Death Cross: the 50-day SMA crosses below the 200-day SMA, indicating that momentum has moved to the downside, generating bearish sentiment.

To identify market sentiment using moving averages, NinjaTrader 8 users can utilize tools such are: [PoshTrader] Moving Average or [PoshTrader] Moving Average Crossover

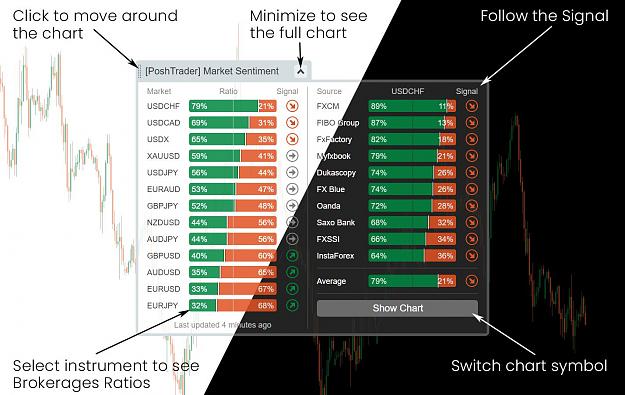

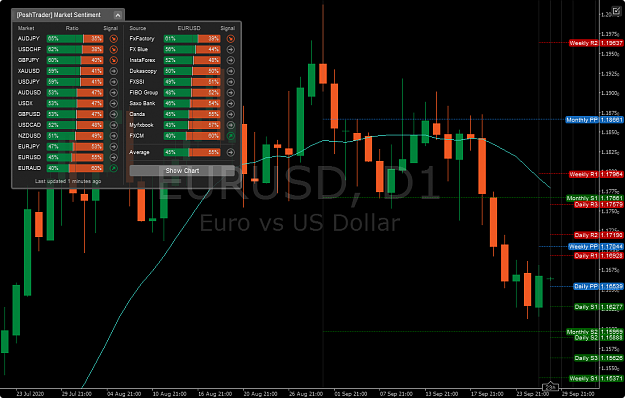

[PoshTrader] Market Sentiment for cTrader

Percentage values showing the current difference between the number of traders, which have opened Long and Short positions on a specific instrument. At that, already closed trades don’t affect the indicator’s value.

This indicator shows the sentiment of individual traders for a specific currency pair. According to the fact that “the crowd is usually wrong,” we should open our trades opposite the crowd’s direction.

[PoshTrader] Market Sentiment indicator is a simple tool to practice the “Basic Ratio Strategy” on featured currency pairs.

Open a long position when more than 60% of traders are short, and open a short position when more than 60% of traders are long. When the ratio is close to the value of 50%, you should not trade.

[PoshTrader] Market Sentiment indicator helps you to analyze the ratio from different brokers to diversify risks. Look for the majority of brokers showing unidirectional signals.

Try it FREE for 7-Days: [PoshTrader] Market Sentiment

Conclusion

Market sentiment is a useful indicator to determine the level of bearishness or bullishness held by investors. Use market sentiment in two ways, as a contrarian and enter a market opposite to crowds, or use the market sentiment as a warning signal that a current or potential trade has too many investors rolling the same way.

Consider using market sentiment in combination with fundamentals and other technical analysis tools.