Greetings Traders, (the following is an edit to benefit all those with jobs)

The following is a trading strategy I think I'm gonna like. If you like it, use it. I called it the zero line reject. The original author calls it something else. The author currently uses it on futures.

It has losers, trading always will have. I have back tested this on the 5m, 15m and the 4H. 4H is my favorite TF.

I will likely use TE with this. I'm still reading up on this, I've never done it.

It has very simple rules, easy peasy. You can have a FT job and trade this with success. That's the main reason I'm sharing this. I was looking for a system for the 4H TF, I had a job then and I still have one.

I will urge all to trade the lower TF during an 'active' session.

I'm compiling a very specific checklist for this strategy, that's how much I like it already. I don't have fancy templates, zips, etc. The following is how it works.

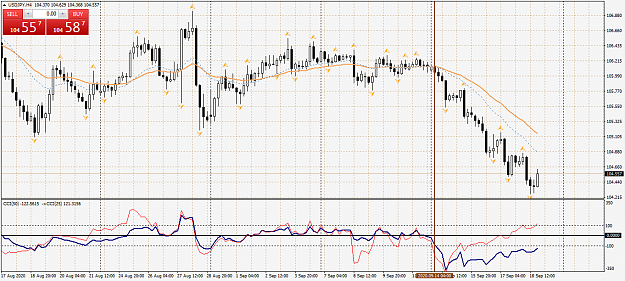

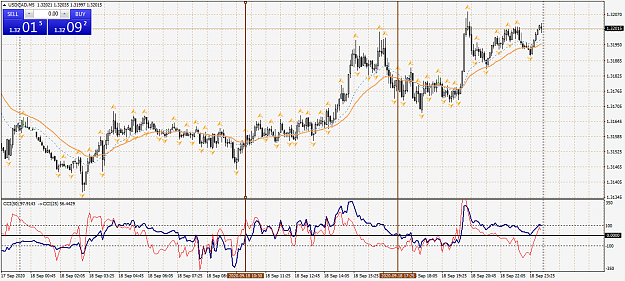

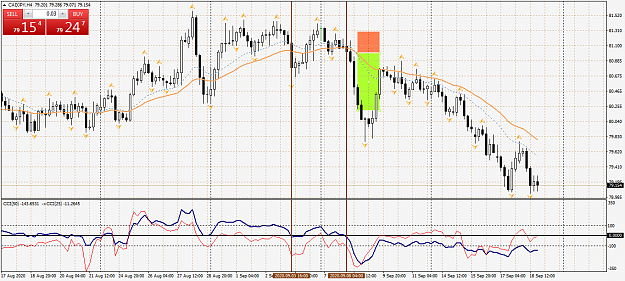

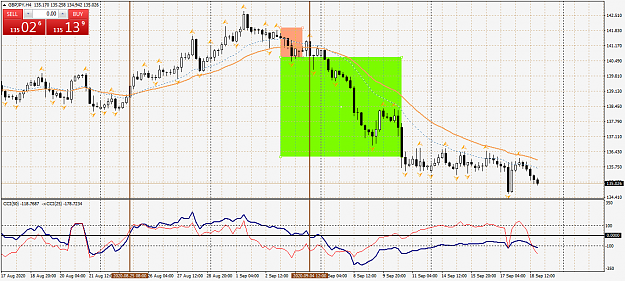

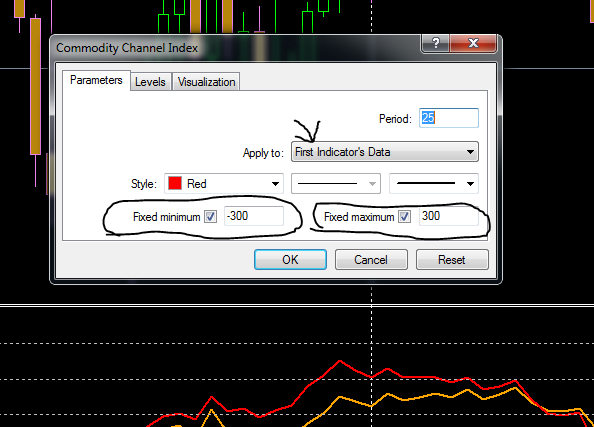

My personal chart will look something like... 4H, 34 EMA, 25 CCI, 50 CCI, fractals {for trailing}. I think that's it.

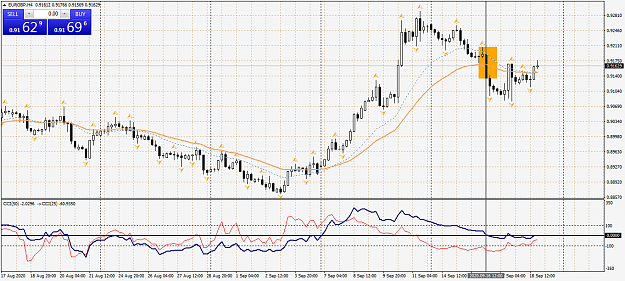

BUY- 25 CCI closes above zero, for 2 periods or bars {avoiding whipsaw}... after that... 50 CCI closes above zero, or has a strong ascending slope towards zero... after that price MAY close higher than the 34 EMA. If it does, I would buy and place stop loss below nearest fractal low.

EDIT~I still use the 50, I've replaced the 25 with a 14. Settings do not make a difference. I often trail with a 50. Those will jobs can spend Sundays evaluating the W1, a few minutes daily evaluating the D1, and take trades on the H4. I still plot and use the 34 EMA. My short entry consists of the 14 closing below the zero line on the CCI, hence the zero line reject. I currently use this on the 30m, 15m and 5m during London. EDIT

Manage-... take a portion off at 1:1 and trail the rest {at minimum set an alert}... trail by fractals when the 25 CCI comes down below zero... adjust stop to the low of the candle when price closes below the 34 EMA. If 50 CCI closes below the zero line, wait for or search out the next trade.

Risk is completely up to you, do not bet the farm.

Many of you enjoy the short TF, I urge you to trade only LO and NYO for best results.

I will post charts. This first chart is way controversial, price makes it to the 34, not necessarily above it, it's your call. I would've traded it, I gave it a vertical line.

Enjoy the testing friends

Reno

The following is a trading strategy I think I'm gonna like. If you like it, use it. I called it the zero line reject. The original author calls it something else. The author currently uses it on futures.

It has losers, trading always will have. I have back tested this on the 5m, 15m and the 4H. 4H is my favorite TF.

I will likely use TE with this. I'm still reading up on this, I've never done it.

It has very simple rules, easy peasy. You can have a FT job and trade this with success. That's the main reason I'm sharing this. I was looking for a system for the 4H TF, I had a job then and I still have one.

I will urge all to trade the lower TF during an 'active' session.

I'm compiling a very specific checklist for this strategy, that's how much I like it already. I don't have fancy templates, zips, etc. The following is how it works.

My personal chart will look something like... 4H, 34 EMA, 25 CCI, 50 CCI, fractals {for trailing}. I think that's it.

BUY- 25 CCI closes above zero, for 2 periods or bars {avoiding whipsaw}... after that... 50 CCI closes above zero, or has a strong ascending slope towards zero... after that price MAY close higher than the 34 EMA. If it does, I would buy and place stop loss below nearest fractal low.

EDIT~I still use the 50, I've replaced the 25 with a 14. Settings do not make a difference. I often trail with a 50. Those will jobs can spend Sundays evaluating the W1, a few minutes daily evaluating the D1, and take trades on the H4. I still plot and use the 34 EMA. My short entry consists of the 14 closing below the zero line on the CCI, hence the zero line reject. I currently use this on the 30m, 15m and 5m during London. EDIT

Manage-... take a portion off at 1:1 and trail the rest {at minimum set an alert}... trail by fractals when the 25 CCI comes down below zero... adjust stop to the low of the candle when price closes below the 34 EMA. If 50 CCI closes below the zero line, wait for or search out the next trade.

Risk is completely up to you, do not bet the farm.

Many of you enjoy the short TF, I urge you to trade only LO and NYO for best results.

I will post charts. This first chart is way controversial, price makes it to the 34, not necessarily above it, it's your call. I would've traded it, I gave it a vertical line.

Enjoy the testing friends

Reno