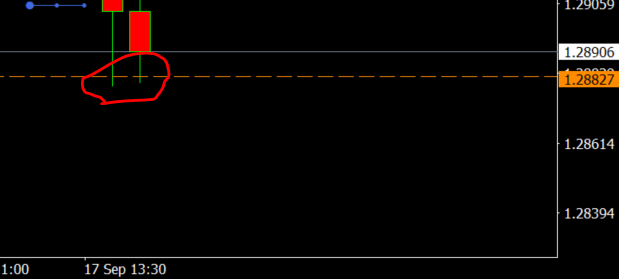

Disliked{quote} I didnít see it ?{quote} Now 52 res (44 support?) although not as clear As the drop was quicker retail sentiment is now 56.5% short, 7% swing since yesterday... it can change quickly if the drop is steep as more shorts will be closed and longs added hourly close back above 62 wouldnít be ideal for bears..

Ignored

those who can, do. those who cant, talk about those who can