ADR Average daily Range Indicator 195 replies

Average Daily Range Table (ADR) 63 replies

Average Daily Range (ADR) - code check 8 replies

what can keep a working strategy to always have a high probability to win each trade? 9 replies

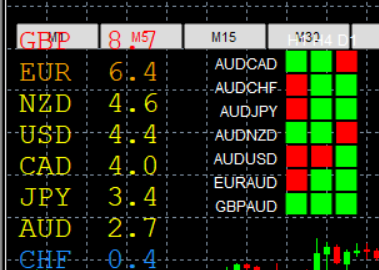

Disliked[quote = NoobM; 13141420] {quote} ¿Qué R: R usualmente toma y cuánto pip establece para tp o sl? [/ quote] mi r:r minimo es 3 a 1, menos no entro en la operación, a veces salen r:r realmente increíbles de 8.1 incluso superiores, a modo ejemplo esta mañana tengo una entrada con rr 11 a 1 en Gbp JPY {image} Como sé que me van a preguntar por que he hecho esta entrada, la explico: He comprobado que cuando rompe N2 y este esta situado en la mitad de ADR High-Low, en un porcentaje altisimo hace el recorrido hasta 100% ADR,por lo tanto veo que el precio...Ignored

Dislikedgbp-jpy tp reached, today i have made 26% profit so far, on all trades i risk 2% account, it is a demo account. Not every day is thoe same, although what I like best about this trade is the risk/risk ratio which is very favourable. It is too early to say that it is a winning strategy, it must be tested longer although it has one issue that I believe is powerful and that is the fact that believe it or not we work with price action as we work with supports and resistances and also with very, very good r:r. An important point is that I have realised...Ignored

Dislikedgbp-jpy tp reached, today i have made 26% profit so far, on all trades i risk 2% account, it is a demo account. Not every day is the same, although what I like best about this trade is the risk/risk ratio which is very favourable. It is too early to say that it is a winning strategy, it must be tested longer although it has one issue that I believe is powerful and that is the fact that believe it or not we work with price action as we work with supports and resistances and also with very, very good r:r. An important point is that I have realised...Ignored

Dislikedhello all (especially for zoheb01, meck1 and jarass1080). thank you for sharing the trading system and the explanation. and I just tried this system, starting mid-August. And this is the result. My question ; how to use this system in mt5 ? and are there any expert advisors for this system (for mt4 or mt5) {image}Ignored

Disliked[quote = dokopy; 13146412] {quote} Co wskaźniki muszą pokazać przy odwracaniu trendu? [/ quote] Buddy, reversing the trend, it's very hard. My work on perfecting this strategy is to capture the profile from the yellow line to the yellow line.Ignored