Disliked{quote} Yea trending pairs are a disaster with counter trading strategies, I was also thinking maybe taking trades which fulfill the requirements at a major S/R level maybe. That way the stop will be protected by the S/R level plus we'll be trading the bounces of those levels. Pretty good confluences.Ignored

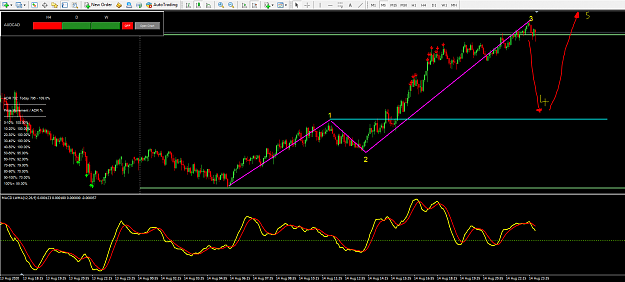

1