QuoteDislikedQuoting MicardoDisliked

Max... I use a stop loss of 50 pips and a profit target of 30 pips. You managed to get 50+ pips today that is excellent, can I ask you what your exit strategy is?Ignored

Micardo, sorry to say I don't yet have an exit strategy. I had set the trade without any limit and just happened to look at the chart about 3pm to see it up at 1.9096 and closed out manually at 1.9093.

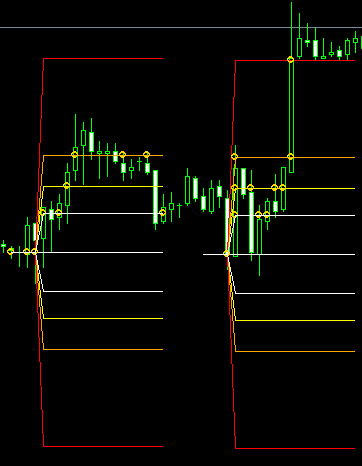

Markj, thanx for posting the chart. If I understand you correctly your starting point is the London open at 8am GMT. On my chart the 8am candle opened at 1.8967. So for the long trade entry point would have been 1.8987. It went up to 1.9026 before falling back. Do you mean that you wait until it hits your upward entry point again (in this case 1.8987) and then re enter the trade? Sorry if I've misunderstood but I'm trying to work out the criteria you use to get the two trades.

Thanks for all the input here

max