Hello guys,

on which time frame is it used ?

If you don’t use a time frame which allows you to systematically take each setup then your hit ratio is just biased, for the better or for the worse, but will therefore only be random.

And even if you take systematically each set up, a few weeks is far from enough, why hasn’t anybody backtested it yet, seems very mechanical to me ?

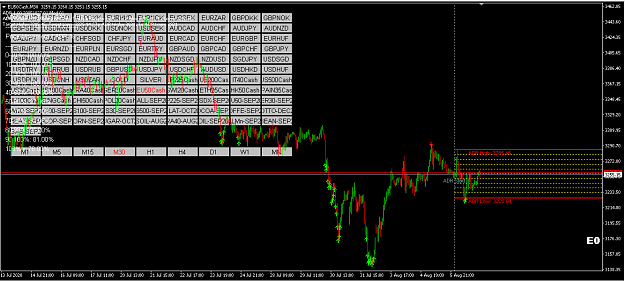

Anyone familiar with the London close strategy? This thread has nothing new, it works great on a volatile market, probably best in August where volume is low and/or during the pandemic that triggered volatility and constantly risk on/off shifting. Actually even a EA based solely on a RSI with a r:r of 1 would have worked.

The problem with this “strategy” is that with a 1:1 r:r it will fail ultimately overtime and to have an appropriate risk:reward (1/3) you will have to get in earlier making it not better because the hit rate ratio will plunge. It works all great during volatility but once a trend is there it will take up all your profits and more.

There is no such a thing as an easy mechanical system, you will have to come up with better than that, which is called discretionary.

Do not get me wrong, I hate to burst a bubble.

Cheers,

on which time frame is it used ?

If you don’t use a time frame which allows you to systematically take each setup then your hit ratio is just biased, for the better or for the worse, but will therefore only be random.

And even if you take systematically each set up, a few weeks is far from enough, why hasn’t anybody backtested it yet, seems very mechanical to me ?

Anyone familiar with the London close strategy? This thread has nothing new, it works great on a volatile market, probably best in August where volume is low and/or during the pandemic that triggered volatility and constantly risk on/off shifting. Actually even a EA based solely on a RSI with a r:r of 1 would have worked.

The problem with this “strategy” is that with a 1:1 r:r it will fail ultimately overtime and to have an appropriate risk:reward (1/3) you will have to get in earlier making it not better because the hit rate ratio will plunge. It works all great during volatility but once a trend is there it will take up all your profits and more.

There is no such a thing as an easy mechanical system, you will have to come up with better than that, which is called discretionary.

Do not get me wrong, I hate to burst a bubble.

Cheers,

LDFX Trading Ltd