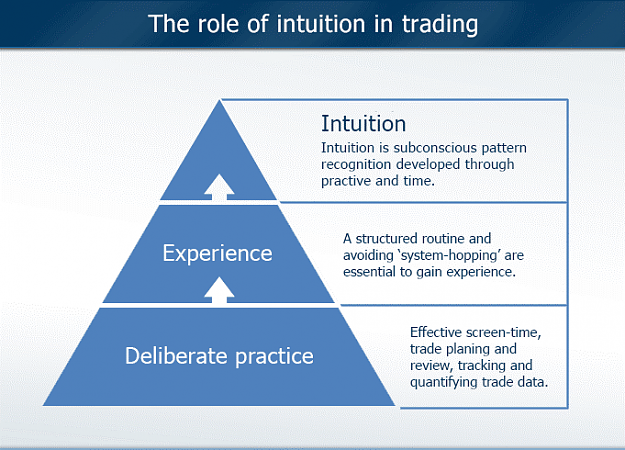

Seems like Technical studies just seem to help you as a newbie. However once must move to other aspects of trading that cannot be described most of time. Further than just technical and fundamental.

The following is a post by a member of thread that i have found very interesting.

"A few quick thoughts ...

1. Most importantly, the right to rely on intuiton has to be earned. Acting on gut feel with no experience to direct it is unlikely to end well. (also see pt. 5)

2. If the subconscious is free to assimilate data and patterns then it can learn, or at least assemble meaningfully, without the conscious realising. By free I mean, at least in the trading sense, unclouded by emotion, available and willing to accept input without prejudice. In time it can then regurgitate its studies usefully. It knows far more than one can simultaneously comfortably hold in the conscious present and has the capacity to direct action far more swiftly and cohesively as a result, as long as the conscious doesn't interfere.

(2.a I play guitar and play best when I am not thinking about what I am playing. This is because the subconscious is then free to provide input, direct control even, without the inhibition of restrictive conscious 'rules'. But the poor beggar has had to suffer my playing endless scales and listening over-and-over to legendary guitarists to be able to do this. Compare sportsmen, golfers having a brilliant day until they start "trying to play well". etc. There's quite a cute book called Inner Tennis that describes this phenomenon.)

3. Back to trading, once the subconscious seems aware of certain patterns it will often whisper, say, "Exit here" with uncanny accuracy, before the conscious is aware of an exit signal.

4. If it is proved correct in so doing a significant number of times, then the task is to consciously understand why. If it has recognised a repeating pattern or market condition then it should be possible to deconstruct this logically. (If I play something on the guitar of a surprisingly good quality of which I genuinely thought I was not capable, almost as if my fingers were doing the work for me, then it must be possible to imprint these new ideas into my conscious technique).

You 'feel' a bull move building, but you can't yet see it in the tape or the chart. The numbers and progression still make no sense. So you study the tape and the chart with the the new knowledge that it must be telling you something important, until the feeling becomes a logically deducted reality. Then that previously invisible intuition can become part of the conscious method and rules applied around it. This is very diffcult, for me at least.

Perhaps the pinnacle of trading is to gather all one's unconscious knowledge (intuitions) into a series of organised, correct judgements regarding the workings of the market, ones which hold true in every situation, and then act flawlessly upon them where appropriate.

5. Beware of fear and greed and other destructive instincts masquerading as useful intuition. For every "It must fall here" that is based on correct intuitive recognition of market conditions, there are likely to be nine instinctive responses that actually mean "I am long and scared and want to take my small profit because that's what my inept fight/flight instinct is telling me." The subconscious is a skilful deceiver, which is a good reason to bring its correct advice safely into the conscious while insulating oneself against its primitive, unhelpful messages.

6. I think successful traders who use intuition never rely on it solely and tend to avoid risk even more fiercely than those that follow more scientific approaches. Successful discretionary traders are in the absolute minority. (This of course raises the perennial question - are discretionary traders simply following more complex and less easily quantifiable rules than their systematic brethren or is there a genuine divide between the two? I would say yes they are but I'd be surprised if you could code those rules in a manner so that they could be automated and therein lies the crucial difference. Viva the brain, for now at least. )

7. The subconscious may understand other traders' emotions more deeply than the conscious and perhaps is thus more tuned into the fluidity, motives, causes and effects of price action than an arbitrary chart viewed by one's rational self can be. This is a statement for which I have no proof, but it ties in a neat half-hitch.

All imho. In the scheme of things I am a rank beginner so plz take with a cruet of salt." -frugi Legendary Member

From Wikipedia -

Intuition is an unconscious form of knowledge. It is immediate and often not open to rational/analytical thought processes. Intuition differs from an opinion since opinion is based on experience, while an intuition is held to be affected by previous experiences only unconsciously. It's hard to form an opinion from knowledge of which you are consciously unaware. (my italics). Intuition also differs from instinct, which does not have the experience element at all. Intuition is trans-intellectual, while instinct is pre-intellectual. A person who has an intuitive opinion cannot immediately fully explain why he or she holds that view. However, a person may later rationalize an intuition by developing a chain of logic to demonstrate more structurally why the intuition is valid. Indeed.

Its like driving a car or doing anything else in life. We don't walk around with books showing us how to proceed next.

We follow our instincts and do as our previous experience has taught us intuitively.

Cheers and hope you find something of interest in the above

S.

The following is a post by a member of thread that i have found very interesting.

"A few quick thoughts ...

1. Most importantly, the right to rely on intuiton has to be earned. Acting on gut feel with no experience to direct it is unlikely to end well. (also see pt. 5)

2. If the subconscious is free to assimilate data and patterns then it can learn, or at least assemble meaningfully, without the conscious realising. By free I mean, at least in the trading sense, unclouded by emotion, available and willing to accept input without prejudice. In time it can then regurgitate its studies usefully. It knows far more than one can simultaneously comfortably hold in the conscious present and has the capacity to direct action far more swiftly and cohesively as a result, as long as the conscious doesn't interfere.

(2.a I play guitar and play best when I am not thinking about what I am playing. This is because the subconscious is then free to provide input, direct control even, without the inhibition of restrictive conscious 'rules'. But the poor beggar has had to suffer my playing endless scales and listening over-and-over to legendary guitarists to be able to do this. Compare sportsmen, golfers having a brilliant day until they start "trying to play well". etc. There's quite a cute book called Inner Tennis that describes this phenomenon.)

3. Back to trading, once the subconscious seems aware of certain patterns it will often whisper, say, "Exit here" with uncanny accuracy, before the conscious is aware of an exit signal.

4. If it is proved correct in so doing a significant number of times, then the task is to consciously understand why. If it has recognised a repeating pattern or market condition then it should be possible to deconstruct this logically. (If I play something on the guitar of a surprisingly good quality of which I genuinely thought I was not capable, almost as if my fingers were doing the work for me, then it must be possible to imprint these new ideas into my conscious technique).

You 'feel' a bull move building, but you can't yet see it in the tape or the chart. The numbers and progression still make no sense. So you study the tape and the chart with the the new knowledge that it must be telling you something important, until the feeling becomes a logically deducted reality. Then that previously invisible intuition can become part of the conscious method and rules applied around it. This is very diffcult, for me at least.

Perhaps the pinnacle of trading is to gather all one's unconscious knowledge (intuitions) into a series of organised, correct judgements regarding the workings of the market, ones which hold true in every situation, and then act flawlessly upon them where appropriate.

5. Beware of fear and greed and other destructive instincts masquerading as useful intuition. For every "It must fall here" that is based on correct intuitive recognition of market conditions, there are likely to be nine instinctive responses that actually mean "I am long and scared and want to take my small profit because that's what my inept fight/flight instinct is telling me." The subconscious is a skilful deceiver, which is a good reason to bring its correct advice safely into the conscious while insulating oneself against its primitive, unhelpful messages.

6. I think successful traders who use intuition never rely on it solely and tend to avoid risk even more fiercely than those that follow more scientific approaches. Successful discretionary traders are in the absolute minority. (This of course raises the perennial question - are discretionary traders simply following more complex and less easily quantifiable rules than their systematic brethren or is there a genuine divide between the two? I would say yes they are but I'd be surprised if you could code those rules in a manner so that they could be automated and therein lies the crucial difference. Viva the brain, for now at least. )

7. The subconscious may understand other traders' emotions more deeply than the conscious and perhaps is thus more tuned into the fluidity, motives, causes and effects of price action than an arbitrary chart viewed by one's rational self can be. This is a statement for which I have no proof, but it ties in a neat half-hitch.

All imho. In the scheme of things I am a rank beginner so plz take with a cruet of salt." -frugi Legendary Member

From Wikipedia -

Intuition is an unconscious form of knowledge. It is immediate and often not open to rational/analytical thought processes. Intuition differs from an opinion since opinion is based on experience, while an intuition is held to be affected by previous experiences only unconsciously. It's hard to form an opinion from knowledge of which you are consciously unaware. (my italics). Intuition also differs from instinct, which does not have the experience element at all. Intuition is trans-intellectual, while instinct is pre-intellectual. A person who has an intuitive opinion cannot immediately fully explain why he or she holds that view. However, a person may later rationalize an intuition by developing a chain of logic to demonstrate more structurally why the intuition is valid. Indeed.

Its like driving a car or doing anything else in life. We don't walk around with books showing us how to proceed next.

We follow our instincts and do as our previous experience has taught us intuitively.

Cheers and hope you find something of interest in the above

S.