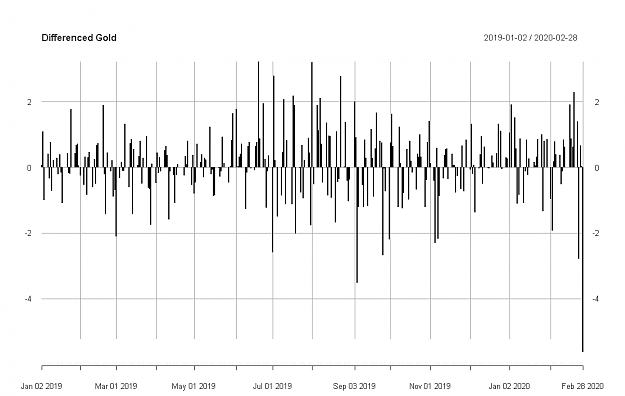

Disliked{quote} For me a trend is a move from point A to point B, where there are more either upward or downward movement. I remember the screenshot posted by some member here where he showed randomly generated chart. You won't tell the difference between real chart and that one.Ignored

'Why do people not realize that if trend-like patterns can be generated by a random walk, the inverse is nót necessarily true.'

Here with the inverse I mean the assumption that the market exhibits behavior that cannot be anything else than being fully described by random walks.

Of course people would be able to profit from trends in random data, but these temporary gains would all tend to be equalized after a statistically significant amount of trades.

1