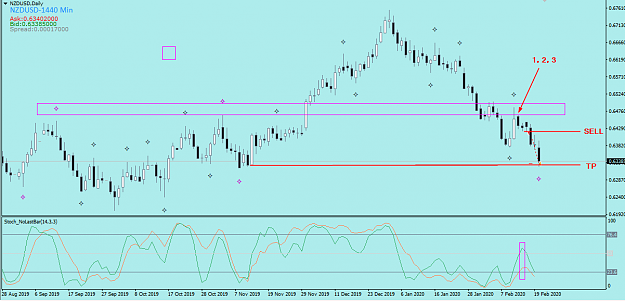

Thanks ghbdr. Trading for 5 years now and this system is the one that makes the most sense in terms of supply/demand or support/resistance. Now I finally feel as if I'm going to be consisently profitable for financial freedom. (in a year or two)

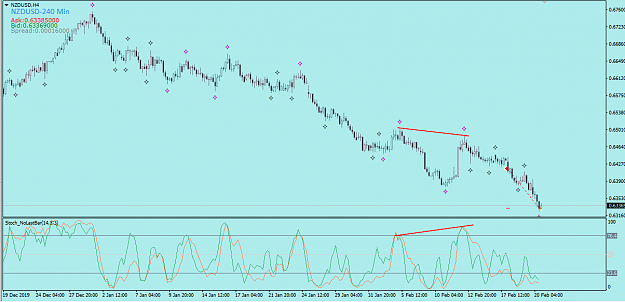

1