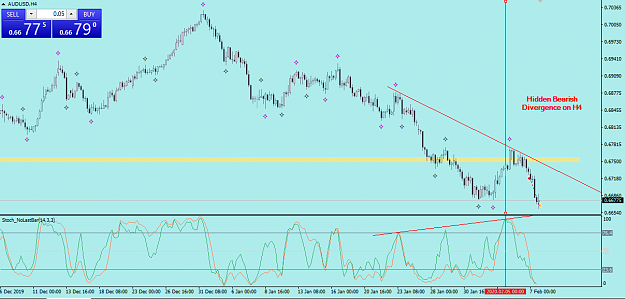

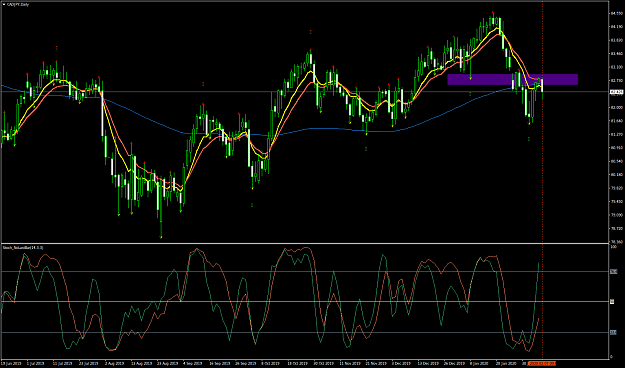

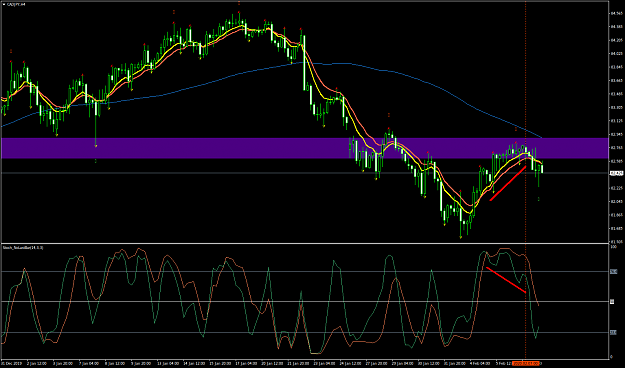

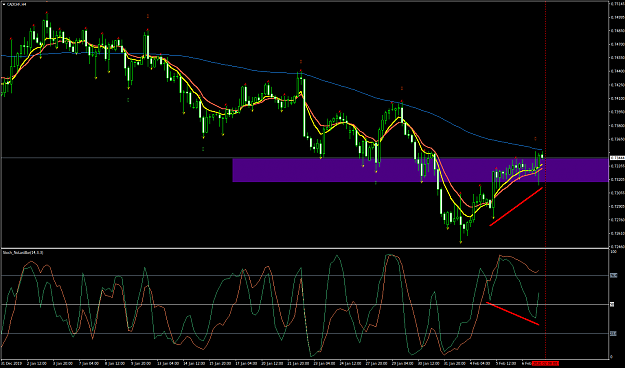

Disliked{quote} It can give you some pips mate, and although you see the elastic divergence and some resistence on W1, i still see a lot of momentum..price recently come from a 5,3,3 divergence on W1...H4 doesnt support the trade either. Well, this is just my opinion, may be Im wrong. I hope you get your pips!..but imho is a little risky.

Ignored

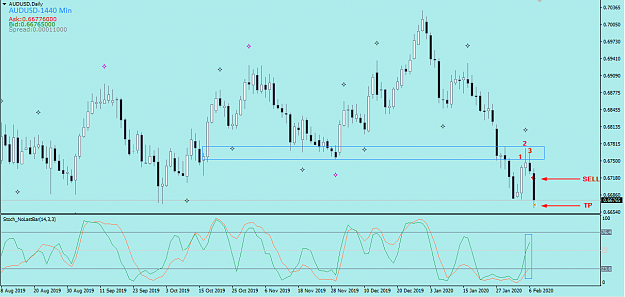

Trade what you see