Dear trader do you think its possible to make profit with a 50% 50% win loss ratio 1:1 tp sl, so to speak random entry no indicator ? With the right money managent?

I would like to start a discussion if such a system is possible to create? I will give some ideas and maybe you can add up some or correct me if you have experience if im wrong.

Im tryna figure out, if a random entry with 1:1 tp sl is possible to be proven , to be working profitable.

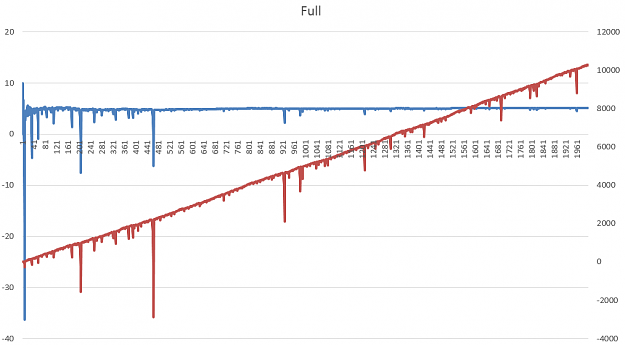

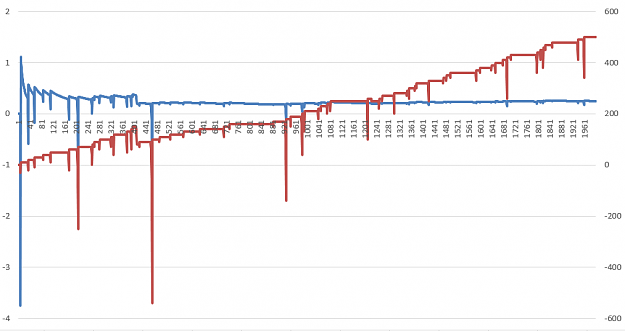

I did a backtes with random entry and i figured out the maximimum amount lost in row was 24 trades, in 3 years. So funny fact if i would have give the programm the command to dont trade with money but count the trades and if 23 errors in a row appear then trade money on the 24th trade. My backtest results would be positive.

What i know wanna ask you, do you believe if i would have an ea and lets say give him the command to wait till 4 fail trades (random entry 1:1 ratio) in a row appear without trading money and give him 6 martingales from then on 1:2:4:8:16:32 i would need 11 trades that fail in a row to loose money. So the probability to lose 11 trades in a row is 0.5^11 that is 0.0004.

That means from 10.000 tries i would loose 4. Which would be in money 6x my martingale amount (statistically) so 6x64$ = 384$ should be the average loss on 10.000 tries. So i would need more than >384 winner with my martingale method in profit to be positive in the result ?

I would like to let code an ea and test it but i wanna hear your suggestion before and do you have any eyperience in something similar ? And do you think im right with my math ?

If you also have an idea how to make a good MM system on 50% 50% i would love to discuss further strategies .

Kr

I would like to start a discussion if such a system is possible to create? I will give some ideas and maybe you can add up some or correct me if you have experience if im wrong.

Im tryna figure out, if a random entry with 1:1 tp sl is possible to be proven , to be working profitable.

I did a backtes with random entry and i figured out the maximimum amount lost in row was 24 trades, in 3 years. So funny fact if i would have give the programm the command to dont trade with money but count the trades and if 23 errors in a row appear then trade money on the 24th trade. My backtest results would be positive.

What i know wanna ask you, do you believe if i would have an ea and lets say give him the command to wait till 4 fail trades (random entry 1:1 ratio) in a row appear without trading money and give him 6 martingales from then on 1:2:4:8:16:32 i would need 11 trades that fail in a row to loose money. So the probability to lose 11 trades in a row is 0.5^11 that is 0.0004.

That means from 10.000 tries i would loose 4. Which would be in money 6x my martingale amount (statistically) so 6x64$ = 384$ should be the average loss on 10.000 tries. So i would need more than >384 winner with my martingale method in profit to be positive in the result ?

I would like to let code an ea and test it but i wanna hear your suggestion before and do you have any eyperience in something similar ? And do you think im right with my math ?

If you also have an idea how to make a good MM system on 50% 50% i would love to discuss further strategies .

Kr