Disliked{quote} @skyway -- @parisboy is brilliant -- and I'm serious. Early on I didn't appreciate his posts so much, but now I do. It's not that I disagree, rather, I come from a different world. Yes -- I don't have his trading experience, but I have different experience and I'm curious whether it can be applied here. Actually, it's more than curious -- I know it can because I've done it before for trend following strategies. The posts here are amazing! And though I can't do each one justice, I want to work through them all and respond the best I can....Ignored

Let's say 15 seconds ? 30 seconds if I am distracted by a cup of coffee.

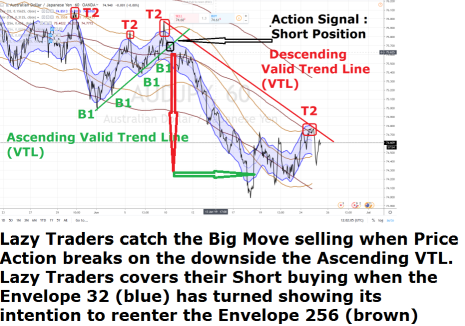

Price action shows ALWAYS the same patterns, endlessly. hence you develop RULES

is it always codable - I am not sure

coding is just a tool.

You need :

- to draw things by hand

- practice on a daily basis post mortem

Hence you will see how things work good and bad a

you could improve your coding and your EA

and the most important understand the LIMITS of the tools you use

3