Good evening! Sorry, I was walking and could not answer right away!

I am very grateful and pleased with your answer.

The lesson is very important.

I understood my two mistakes:

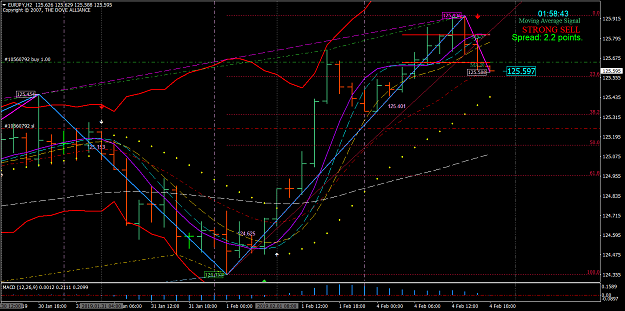

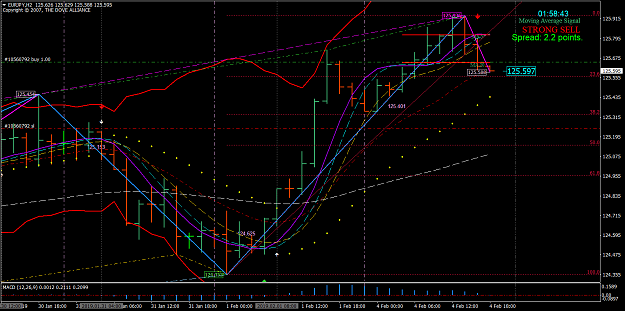

1. I traded a range. Took the basis of a blow in the DB merger supports. But the BB bands were no longer flat, but began to open. We moved to consolidation from rendzh.

2. In consolidation, I needed to see either trend synchronization on H1, H2, or Fibo H2 synchronization, H4. And trade to the nearest resistance

This is what I understood in the moment. I will reread your lesson to full understanding.

Thanks again, respectfully Irina

I am very grateful and pleased with your answer.

The lesson is very important.

I understood my two mistakes:

1. I traded a range. Took the basis of a blow in the DB merger supports. But the BB bands were no longer flat, but began to open. We moved to consolidation from rendzh.

2. In consolidation, I needed to see either trend synchronization on H1, H2, or Fibo H2 synchronization, H4. And trade to the nearest resistance

This is what I understood in the moment. I will reread your lesson to full understanding.

Thanks again, respectfully Irina

Either I will find a way, or I will make one...