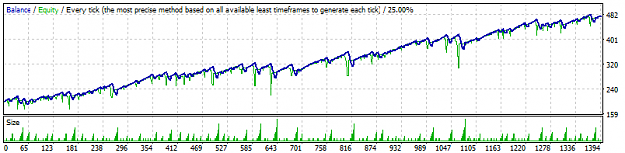

people say "to make money The key points are money management and discipline",

i wonder what is money management? is it martingale?

you cant predict the future price. so when should you add your position ? how did you know you wont fail?

i wonder what is money management? is it martingale?

you cant predict the future price. so when should you add your position ? how did you know you wont fail?