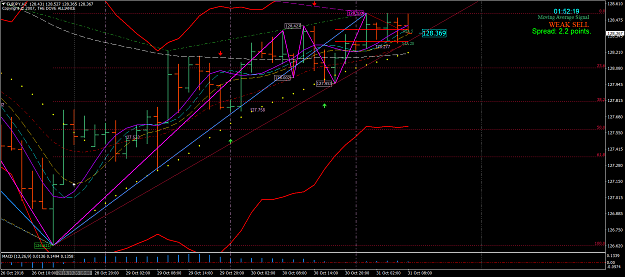

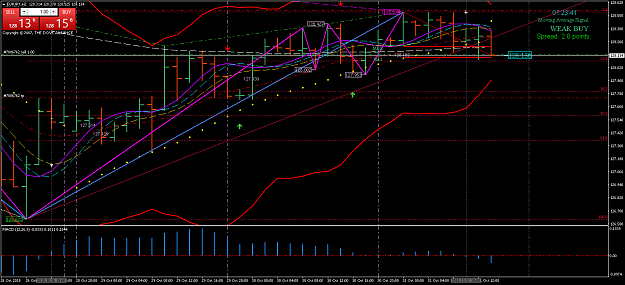

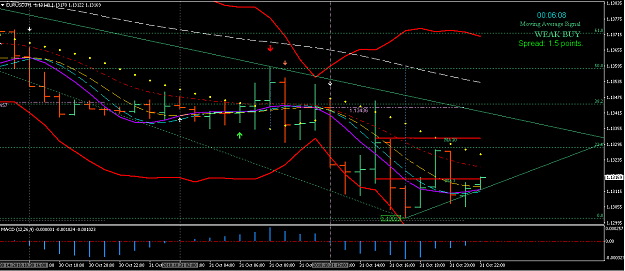

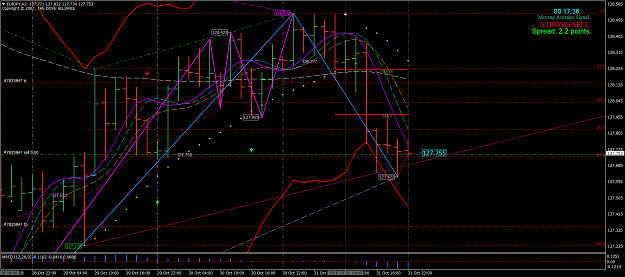

Disliked{quote} This is what I call an "idiots trade" in not knowing the rules. This statement is false: "DBSAR / FIBO / Divergence has the control." You have a multiple major support and still you want to go short; not even evaluating the resistance as a stopper. You might get lucky as you do once in awhile. You have a major problem and that is interpreting the rules instead of knowing the rules. And most times you interpret the rules incorrectly. So your excuses are out of the box. For right now - in the moment - you have the 23.6 Fibo, EMA, and the Parabolic...Ignored

Not going to lie, these past several weeks I been feeling like a lone soldier on the battlefield without his General... and it sucks Master feeling this way.

Master, I know I have no right to ask you to come back and train the last few of us. This Paradox is my all-in in life, I failed at everything, all the chance and opportunity that I have been given - I fucked it up and the only person to blame is ME. I must graduated the Paradox, to show everyone that - NO I'm not a failure in life! But without you my graduation is out of reach Master... like a freshman in high school with his book ready to learn but no teacher in sight.

Master I need your guidance, I will do anything everything that you asked . What time you want me to post my plan? so it would be easier for you, Or don't post plan until this or that? anything to make it easier for you.

Thank you again Master for this amazing Paradox,

Will.