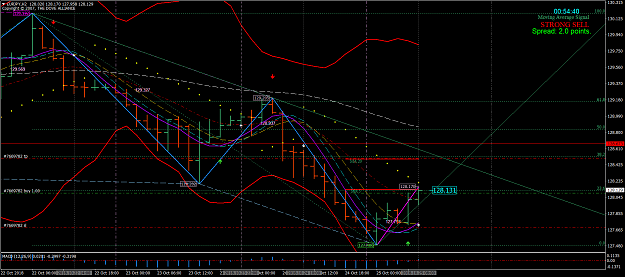

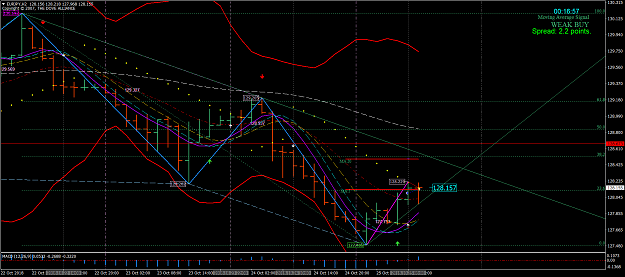

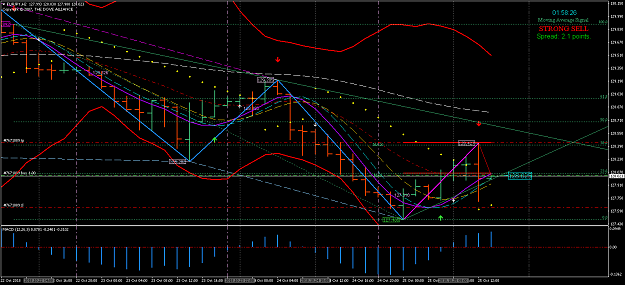

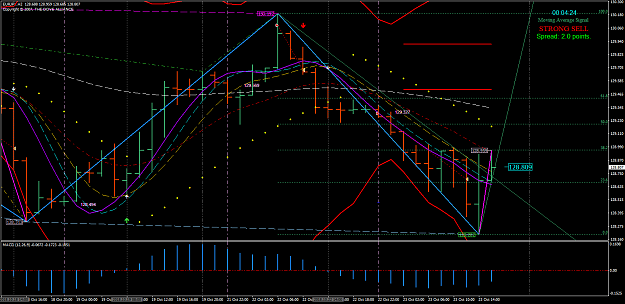

Disliked{quote} Entry: Short, 10:00 open candle. Rule / confluence : I know the entry its sort of out of nowhere, but the H2 Parabolic just flip for the down. The candle opened near H1 PURPLE and right under H2 FIBO 23.6 + DB has not reconnected with SAR yet. {image}Ignored

Self-evalution:

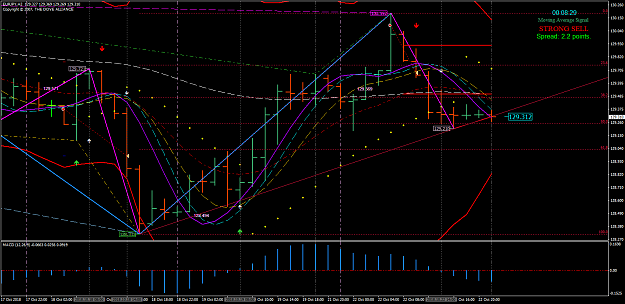

The market is in a downtrend. H1 and H2 was in sync for the downtrend as soon as H2 Parabolic flipped for the down. When SAR connected bottom without DB, I just knew DB had to join SAR because of the downtrend, and also EMA PURPLE crossed for the down on the entry candle. Notice when I made the entry, standard Divergence was not bottom - so the market was not going to retrace toward EMA resistance and come back down to bring out the hidden Divergence yet.

Thank you Master, Paradox for the win!

3