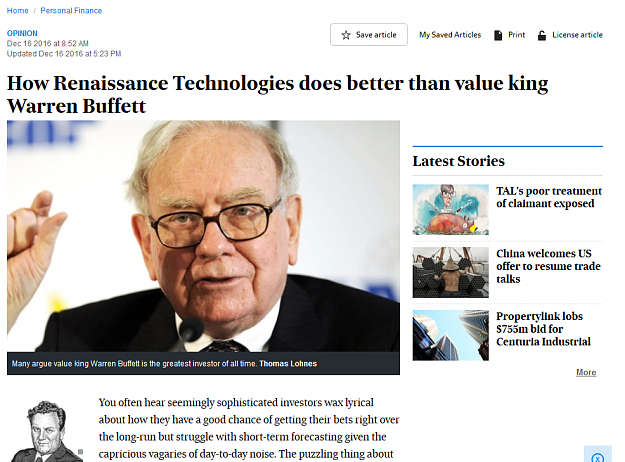

Disliked{quote} No, Berkshire Hathaway is the biggest and most profitable hedge fund with market cap of US600 billion. They don't use quants or mathematical modelling or programmers or EA or indicators. They made 65 billion last year. Banks go to them to ask for bailouts. Renaissance Technology uses systematic trading, mathematical modelling, huge number of quants, lots of computers & programmers. They make a million trades a year or was it a month. They trade the 1 second timeframe. If you want to emulate them go ahead. I doubt if Renaissance made 65 billion...Ignored

LOL.

1