I've been trying to find threads regarding my question "How to buy/sell the dips in a trend?" in ForexFactory and other websites, but sadly with no success (at least I was not able to implement it correctly). If anyone has a link to a thread that explains exactly that, please link it, I'd appreciate it.

So, my question is: how do I buy or sell the pullbacks/retracements in a trend?

I've been trading the trend for the past few months now, learning as much as I can and trying to implement everything what I have learned so far.

So far, the most success I had with was as following:

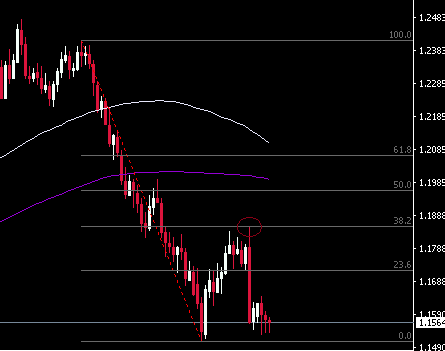

- Retracement back to the 50 EMA

- Stochastics are in overbought/oversold (I don't like it, but I haven't found a way yet to do it without an oscillator)

- Together with a confluence of SR ("normal" SR, round number or pivot).

- Candlestick patterns, mainly engulfing

What I do works fine - it's not very good but something I can build upon. However, I have some issue with it:

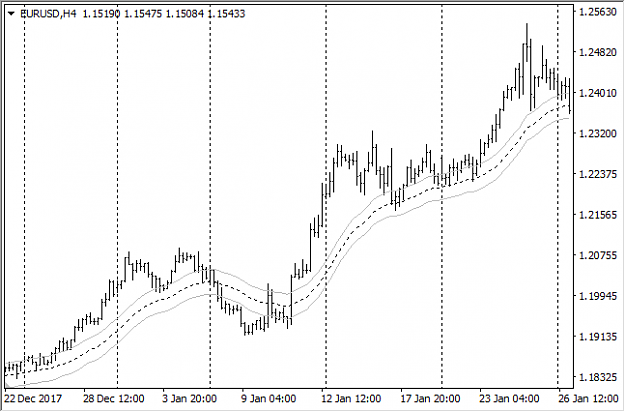

- The 50 EMA is often slow, thus, I miss some trade in a strong trending market. I am also not sure how to catch pullbacks that are very small pullbacks which do not retrace back to the 50 EMA.

- Also, which smaller pullbacks in a strong trending market have high probability working out? Which factors could I consider?

- When it trends strongly, and it pulls back slightly, the oscillator often doesn't go into overbought/oversold(depending on the period of course, but I use the standard settings), which for some reason I automatically skip trades and miss a lot of the move. Something I want to improve on which would scream for understanding price action and removing that damn oscillator (lol)

- TP and SL placement if it doesn't pull back deep enough. Also, generally TP and SL when trading the 50 EMA.

- I also do not consider analyzing one time frame higher. Is that necessary? If yes, then what would I be looking for? For me higher TF just means buying/selling the bigger retracement?

Is there anyone trading the dips successfully and is able to share some insights? I've been back and forward testing a lot but not sure why I am stuck at figuring out a better way to buy/sell dips. Most strategies include MA crosses which I am not a big fan of .. or maybe that's the solution? Hmmm ...

Thank you for any contributions!

So, my question is: how do I buy or sell the pullbacks/retracements in a trend?

I've been trading the trend for the past few months now, learning as much as I can and trying to implement everything what I have learned so far.

So far, the most success I had with was as following:

- Retracement back to the 50 EMA

- Stochastics are in overbought/oversold (I don't like it, but I haven't found a way yet to do it without an oscillator)

- Together with a confluence of SR ("normal" SR, round number or pivot).

- Candlestick patterns, mainly engulfing

What I do works fine - it's not very good but something I can build upon. However, I have some issue with it:

- The 50 EMA is often slow, thus, I miss some trade in a strong trending market. I am also not sure how to catch pullbacks that are very small pullbacks which do not retrace back to the 50 EMA.

- Also, which smaller pullbacks in a strong trending market have high probability working out? Which factors could I consider?

- When it trends strongly, and it pulls back slightly, the oscillator often doesn't go into overbought/oversold(depending on the period of course, but I use the standard settings), which for some reason I automatically skip trades and miss a lot of the move. Something I want to improve on which would scream for understanding price action and removing that damn oscillator (lol)

- TP and SL placement if it doesn't pull back deep enough. Also, generally TP and SL when trading the 50 EMA.

- I also do not consider analyzing one time frame higher. Is that necessary? If yes, then what would I be looking for? For me higher TF just means buying/selling the bigger retracement?

Is there anyone trading the dips successfully and is able to share some insights? I've been back and forward testing a lot but not sure why I am stuck at figuring out a better way to buy/sell dips. Most strategies include MA crosses which I am not a big fan of .. or maybe that's the solution? Hmmm ...

Thank you for any contributions!