Hi parisboy - thank you for your post. Following Medici's comments I have read your thread and enjoyed your original ideas. However, so far, I have not been able to adapt them to my short term, ID trading. I'll take another look.

Kind regards

Islander

Kind regards

Islander

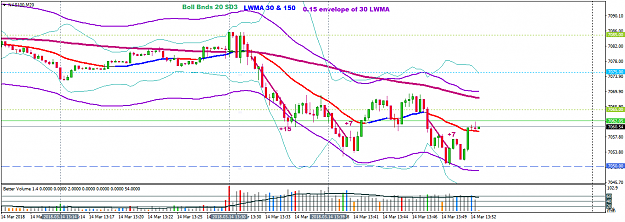

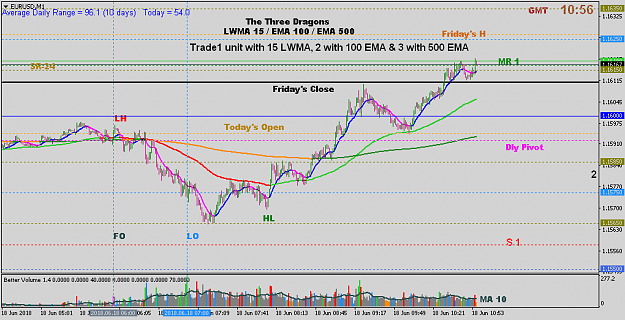

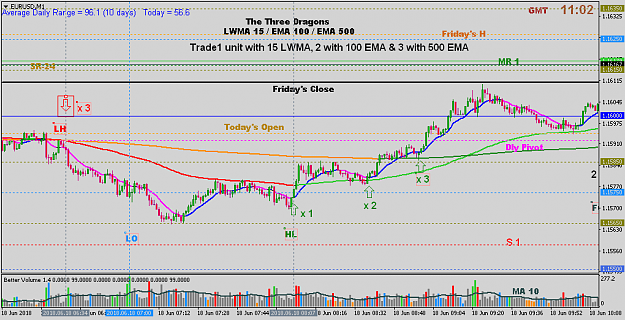

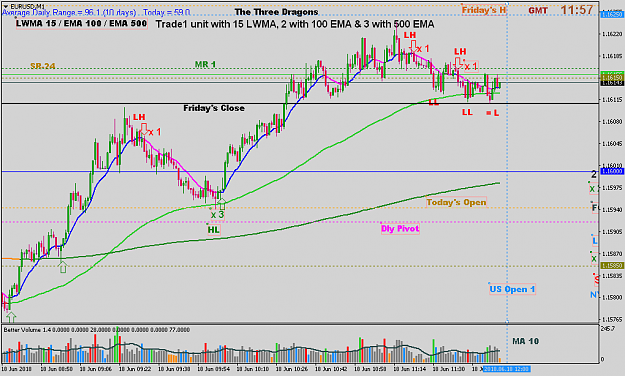

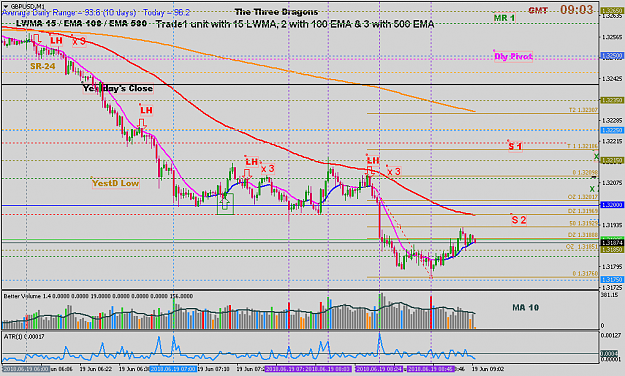

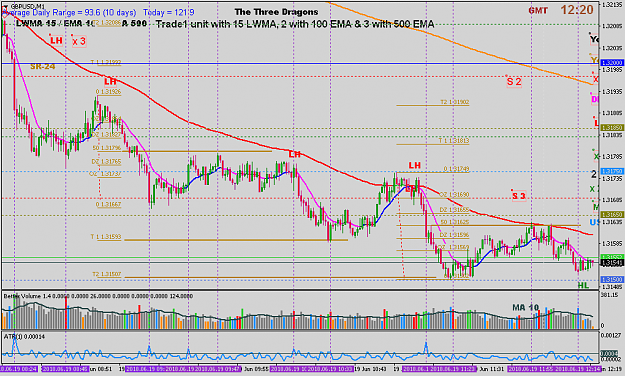

Trading Levels with WRBs