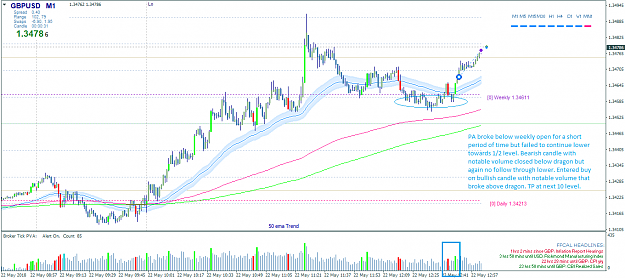

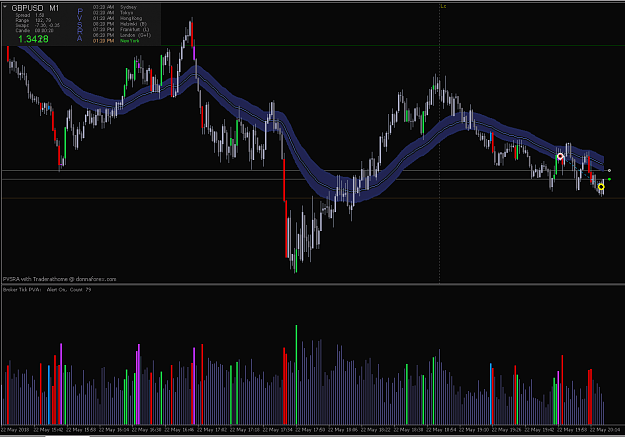

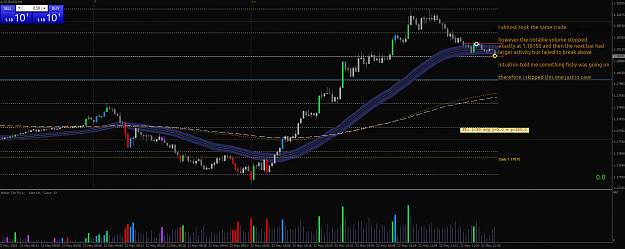

DislikedTrade #19 | EU 1M | 0.50 size | - 5 pips | = - 23.93 Euro A typical PVSRA setup, but didn't work out for me. Here is what I saw: - Price bullish since London Open - Retracement to Dragon, rejection with notable volume. Volume was also decreasing on the way to the dragon. - Entered and got taken out I guess not my day hehe. Feedback is appreciated. {image}Ignored

Answering your previous questions:

1) I don't really trade Asian session (I know, I sound like those guys answering questions on Amazon saying 'I don't know, I didn't buy it for myself'

2) No fixed hard SL for me, it's usually under some level, but I close it manually 95% of the time

2