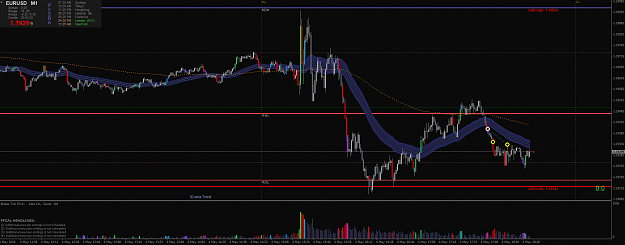

Disliked{quote} Rays, Wisely used self control, many other opportunities will developYou might be correct... Statistics show that the dragon might act in times as S/R and often PA is repelled from and attracted to the dragon.. However the market is inefficient but very effective and does whatever it wants or takes to accumulate money... Keep in mind that (overal) Price action at or around key levels (i.e. whole, half, quarters and 10 and 5 lvls) in the present and past, are more important than the dragon itself... May your journey be a delight to...

Ignored

1