DislikedHmm. Just one more indicator from Ray and every thing will be fixed hmmm. And I recall some of Rays webinars where the aim was to teach you to trade regardless of trading platform and indicators, so that you could work at any hedge fund or prop firm.Ignored

There is nothing that needs to be fixed - but there are still improvements which can make successful trading technically easier for retail traders, such as being able to have everything they want in a single platform (instead of perhaps feeling the need to use 2 or 3 or even 4).

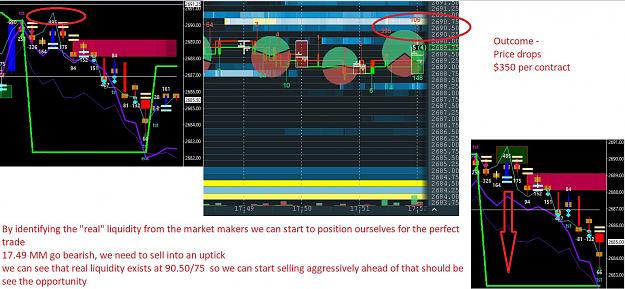

Any Prop Firm or Hedge Fund doing short term trading will have access to some sort of advanced OrderFlow software, why should retail traders deny themselves it?

Note that since I switched charting platform from MT4 to Sierra Chart ( 3 years ago) I have not used any non-standard indicators at all.

DislikedHave to say I've been enjoying some of Mark Coe's free content on Youtube. Trading "level to level" the old fashioned way.Ignored

There is nothing wrong with what Mark teaches apart from ignoring Value, Sentiment and OrderFlow.

But hey if you really want to limit yourself like him, be my guest. Just don't tell me it isn't inferior !

[quote=hostwey;10973329].... But its basic support and resistance. "but but support and resistance doesn't work" Well yes it does. /quote]

With Basic Support and Resistance you have to be lucky! And to quote Clint Eastwood: " Do you feel lucky, punk?"

Or would you rather be smart and be able to read from Value whether a price pattern is an Accumulation of Longs or an Accumulation of Shorts?

Because the price pattern is exactly the same!

[quote=hostwey;10973329] You just seem to be wanting absolute certainty in every trade, and regardless of the number of indicators and education you are never going to get that. Perhaps trade with less size? /quote]

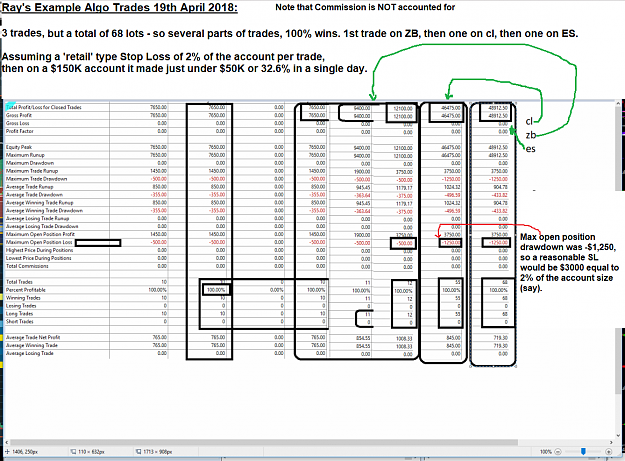

Yes, that particular hangup is one from which a lot of retail traders suffer. But why not gain the most certainty you can? After all most people (but apparently not you) would rather trade with >80% probability than with just 55% probability at best.

[quote=hostwey;10973329] How many hours do you practise in front of a screen, trading either on a demo, or by winding back the charts on MT4 strategy tester? I think trading is a bit like golf. Its OK knowing the theory but you will always be practising your swing. /quote]

I completely agree that lots of practice is required. That is a part of the work that I put in every day after trading. The main work is before Trading. You don't say how many hours you put in, but to get yourself to the >80% winning trades level that I regularly achieve while rejecting all the added edges that Ray teaches, I suspect you would be burning out your eyeballs!