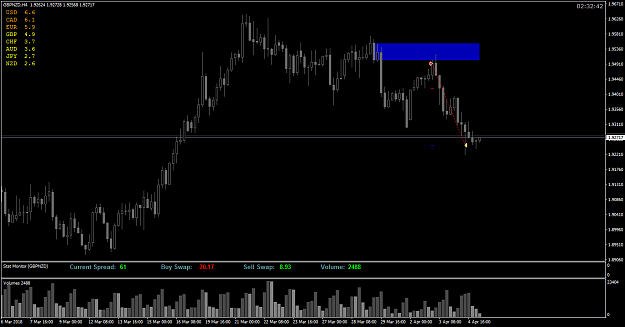

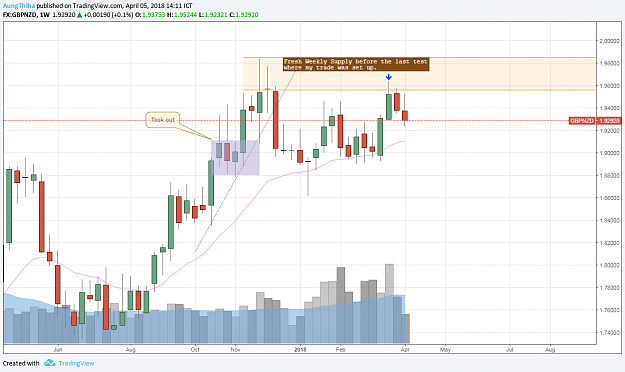

DislikedUSD JPY Hii ,Please Correct me If I am Wrong ... these are my thoughts about usdjpy...Price Is About to reverse {image} {image}Ignored

There is another overlapping DZ below your W1 DZ.

I am interested in that one. However, seeing that it is not fresh and had a deeper penetration, I will wait and observe where the price intends to go.

Live life king size !