Disliked{quote} This depends on how you trade For example, I personally have not faced more than four sessions and that because I trade liquidity time and with the use of sensitive areas, either the rise or fall of the price and this success rate 90/100 Of course with the mony managementIgnored

Liquidity time? Sensitive areas? Rise or fall?

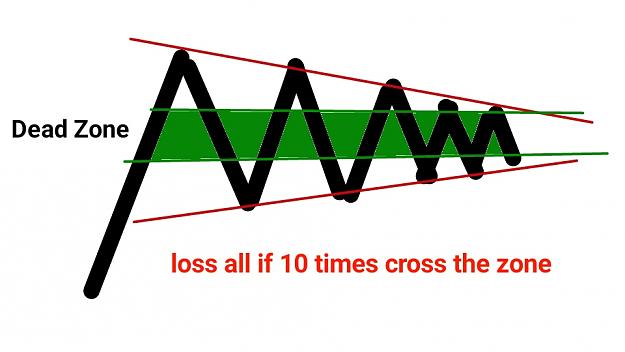

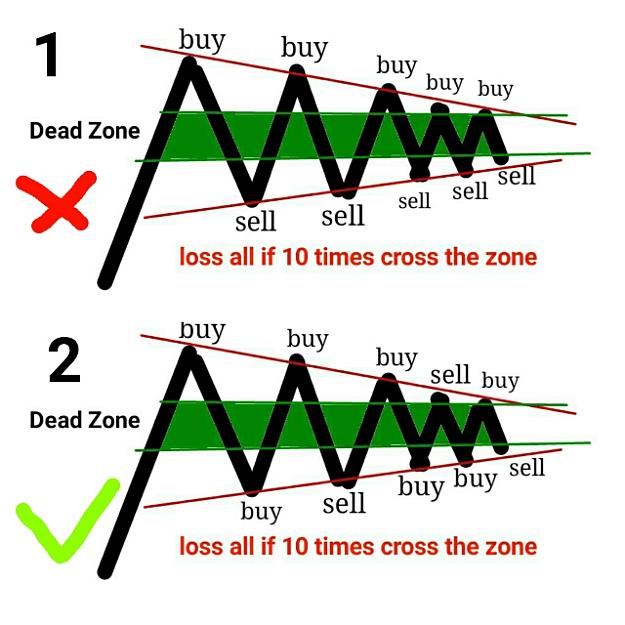

Isnít it like this that once recovery starts it always buys and sells at the same price? Or did I miss something?