Hi,

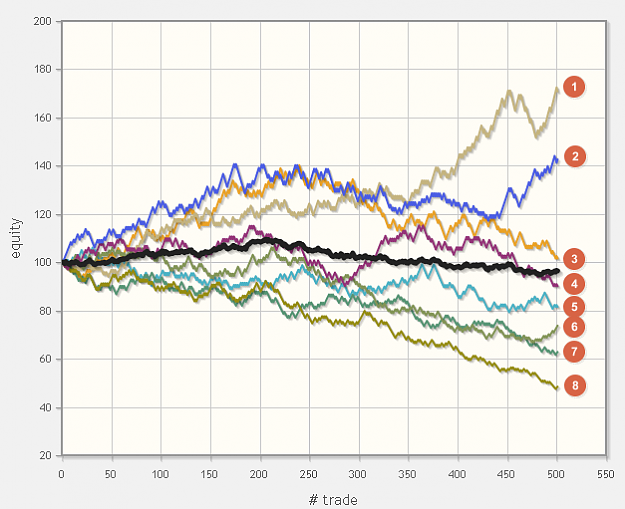

recently I heard of an approach, which can deliver best -opposite- results.

If you have a really bad EA, which performs negatively (min. 90% backtest results/or live demo trading), you have to change settings to the opposite, et voila... you'll receive a very good EA.

Does anyone of you has a very bad EA - and is willing to improve it?!

Post them here {with mql4 code}

recently I heard of an approach, which can deliver best -opposite- results.

If you have a really bad EA, which performs negatively (min. 90% backtest results/or live demo trading), you have to change settings to the opposite, et voila... you'll receive a very good EA.

Does anyone of you has a very bad EA - and is willing to improve it?!

Post them here {with mql4 code}

Check page 1 for all infos...