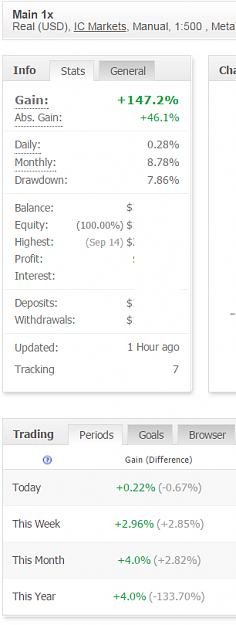

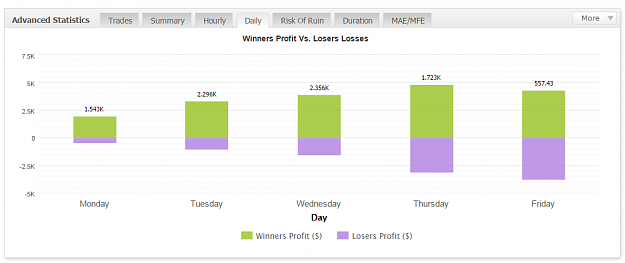

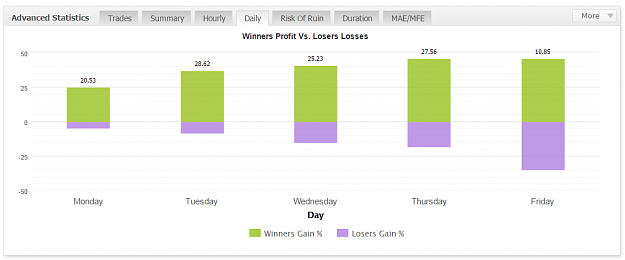

Disliked{quote} perhaps it isnt the best to try to tame DAX or Nikkei with relative small equity, and no flexibility to really size for the trades. maybe a disadvantage, maybe not. however, if something working dont change it. it also apply the way that if something not working look to change it! this is a simple game to keep score, just have to look at the equity. instantly tells you if things working well or not.Ignored

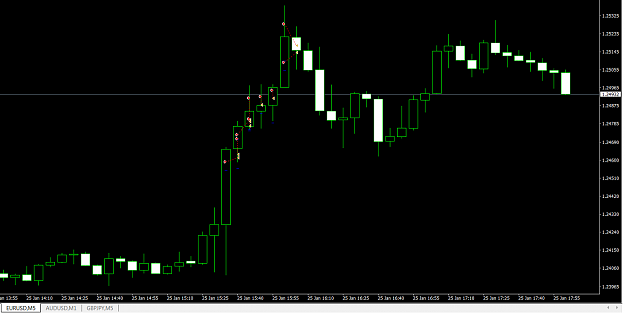

On a side note, I'm dropping DAX and Nikkei for a while and will trade GU you're right on point PF! my tiny account can't handle that DD especially Nikkei it is wild. If you can't keep your greed under control it will chew you up without hesitation. By greed I was drawn towards Nikkei and DAX, especially Nikkei. But I'm not on cloud 9 anymore. Realistic expectation, ? you say I've got it now ! thanks to PF.

I love that DD table, whenever I feel myself getting into "revenge or overtrade" mode I try to remind myself where I was once , broke level. Regardless of the money lost big or small blown account is a blown account it feels nasty. And much like you I guess we all hate to be wrong. So double the trouble. Its not fun at all. And I don't wish anyone to go through the process.

Tape reading is an ART