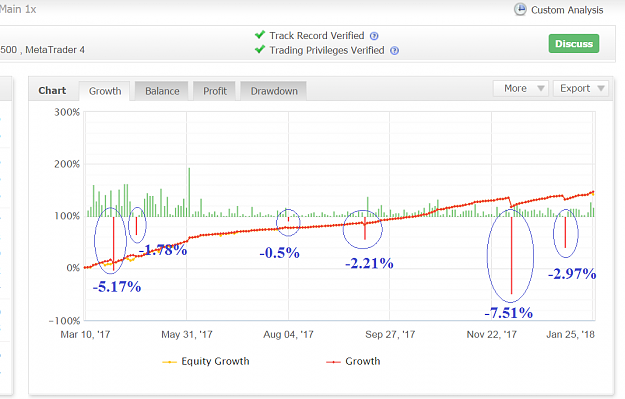

By curiosity, is the performance % of Fixi account similar with the Master acc or is a noticeable difference?

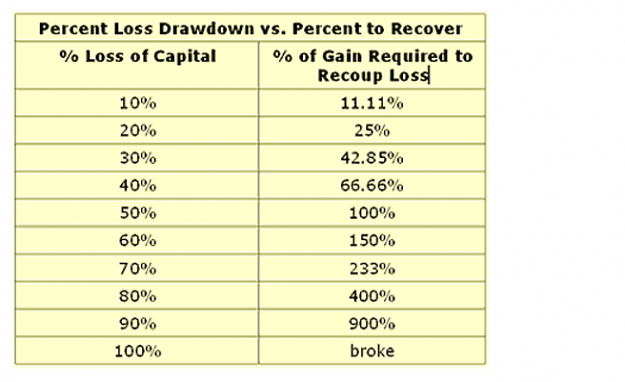

As Fixi gives more money but limit dd to 3.5% in the end you have the extra issue of trading more capital = harder to have to order filled at a price close to the master.

In the end, a prop firm deal looks better.

As Fixi gives more money but limit dd to 3.5% in the end you have the extra issue of trading more capital = harder to have to order filled at a price close to the master.

Dislikedfor comparison: a 'prop firm' offering 75% profit share would need to fund me 80k to be on equal groundsIgnored

?!? Profit This Year:

€136