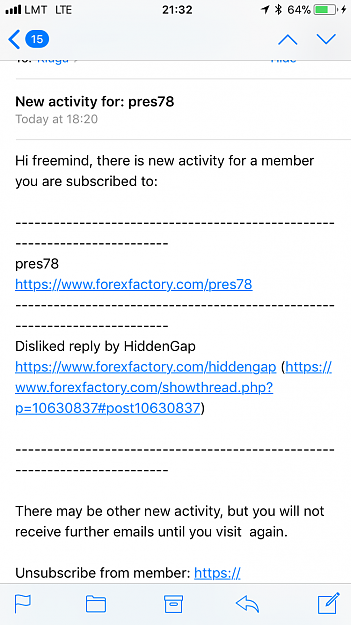

Disliked{quote} Hi HG, the following bar to one you marked as BO with absorption is an hidden upthrust, & this upthrust is followed by a ND, in realtime shouldn't you be wary about this lil sequence here. Where was your trade entry on this chart if you could show us. Or after this BO would you look for entries on lower TF? thanks {image}Ignored

The more you learn the more you earn