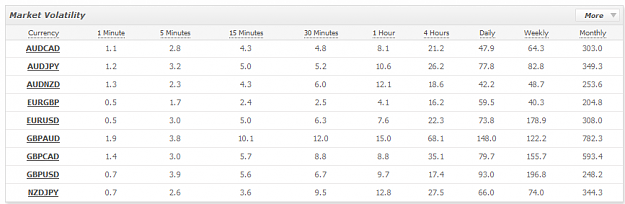

Disliked{quote} I never take 1 data source as the real deal until I've checked them several other sources. The correlation tables used in myfxbook are good enough for use in this strategy. If you have the time you can simply import reliable data into Excel and do the corrlations yourself. I've done this as a simple check for several different periods on multiple pairs. I'm not looking to have 100% correlation. Correlation actually changes over time, more so over shorter time periods than longer. What I'm after is a general behavior for the time frame of...Ignored

You exposed an improvement using correlation for build a TS and I commented you 2 problems I see with this approach and the most probable no positive effect you expect.

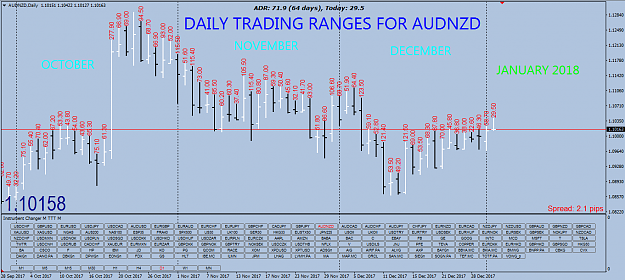

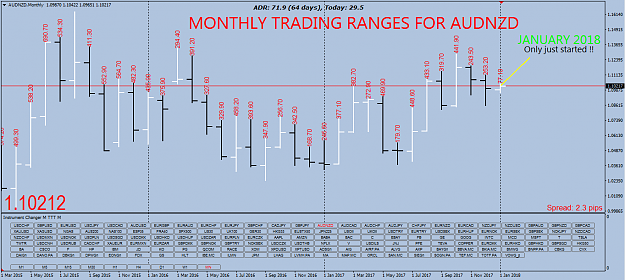

Im not doubting about if correlation data is good or not ( I only told as I dont know formula I take explained formula as reference ). I'm talking you cant use it without do some corrections because that "raw" correlation not take in consideration difference in pair movement ( ADR or volatility in a generic way ). When you create lot size you use pip value for compensate the difference in pairs values. With correlation is same but you have "normalize" ADR value in those pairs. You cant change lot size for normalize that volatility in pairs as you use for create octaves

For me correlation in TS selection can be useful for decide what direction will have every pair in that TS ( removing left hand & right hand rule ) and avoiding force a bad trade by fixed original rule but I dont think will have big effect in results for exposed in above post...

Try don't lose pants never...