DislikedDoes anyone trade regularly ? What I mean is daily at London opening maybe USA opening?Ignored

- Post #31,342

- Quote

- Dec 6, 2017 8:16am Dec 6, 2017 8:16am

The best way to help the poor is not to be one of them.

- Post #31,343

- Quote

- Dec 6, 2017 8:21am Dec 6, 2017 8:21am

Know yourself before fight with the market.

- Post #31,346

- Quote

- Edited 10:30am Dec 6, 2017 10:11am | Edited 10:30am

The more you learn the more you earn

- Post #31,348

- Quote

- Dec 6, 2017 1:01pm Dec 6, 2017 1:01pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

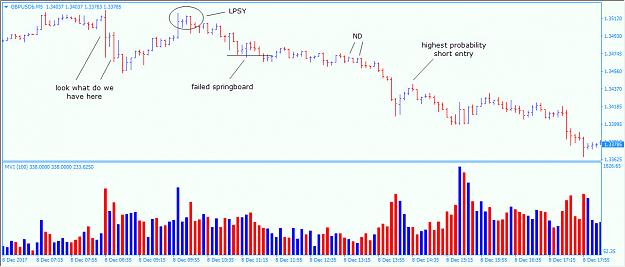

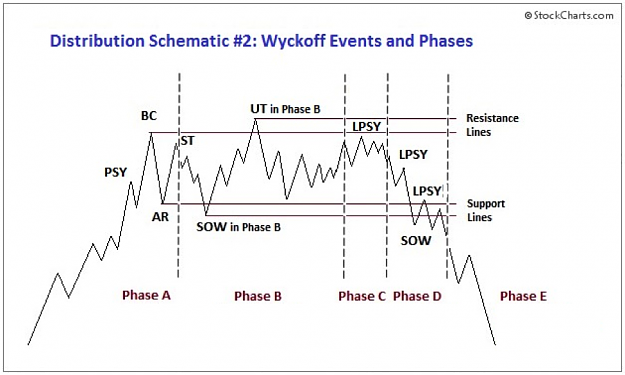

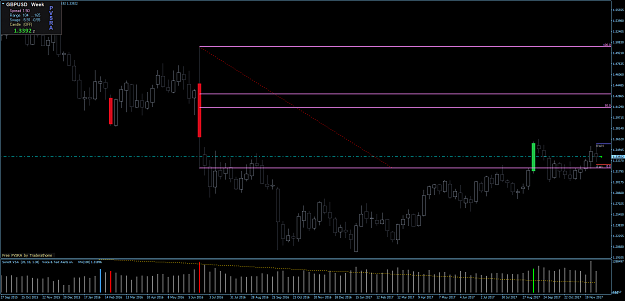

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #31,352

- Quote

- Dec 6, 2017 6:40pm Dec 6, 2017 6:40pm

- | Membership Revoked | Joined Sep 2017 | 422 Posts

NO MATTER THE SITUATION,NEVER LET YOUR EMOTIONS OVERPOWER YOUR INTELLIGENCE

- Post #31,356

- Quote

- Dec 8, 2017 2:20am Dec 8, 2017 2:20am

The loss was not bad luck. It was bad Analysis - D.Einhorn

- Post #31,357

- Quote

- Dec 9, 2017 1:09am Dec 9, 2017 1:09am

The loss was not bad luck. It was bad Analysis - D.Einhorn

- Post #31,359

- Quote

- Dec 10, 2017 10:53am Dec 10, 2017 10:53am

- Joined Apr 2007 | Status: HARD SHYT SCUBA TRADER | 20,883 Posts

Blogging daily now at www.volume.zone

- Post #31,360

- Quote

- Dec 10, 2017 10:57am Dec 10, 2017 10:57am

- Joined Apr 2007 | Status: HARD SHYT SCUBA TRADER | 20,883 Posts

Blogging daily now at www.volume.zone