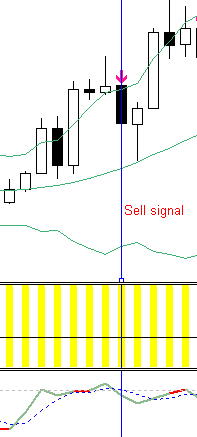

Thank u makemo8... This system has a very good win ratio... Most of the trades are successfull... And if you avoid trading during big news, you get better results...

- Joined Aug 2015 | Status: Coding Magician | 2,675 Posts

Vucking good EA coder... https://t.ly/AZjRM

#14 All Time Return:

496.4%