Hello all.

Simple scalping. Thought I'd share the strategy I use.

Scalping suits me. I'd rather be out of the market more often than in it.

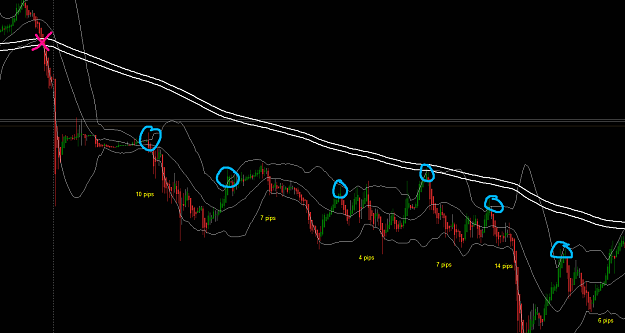

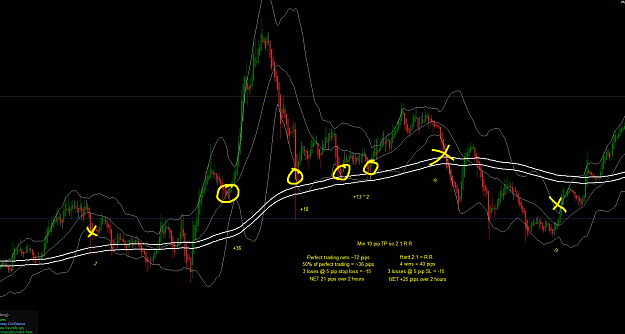

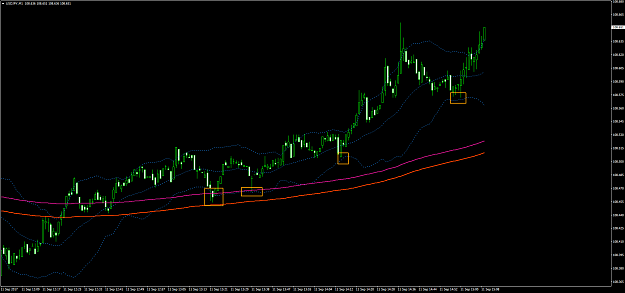

1 or 5 Min chart, Any pair, low spread.

Bollinger bands 25:2:Close

Smoothed MA 120 High

Smoothed MA 120 Low

The double MAs are handy when price is there. Stops you wondering where price is closing and gives a bit of a buffer.

Direction- BB ma in relation to main MAs

Sell off upper band TP lower band.

Vice versa for long

If market is sideways, still valid but better value when MAs start to trend.

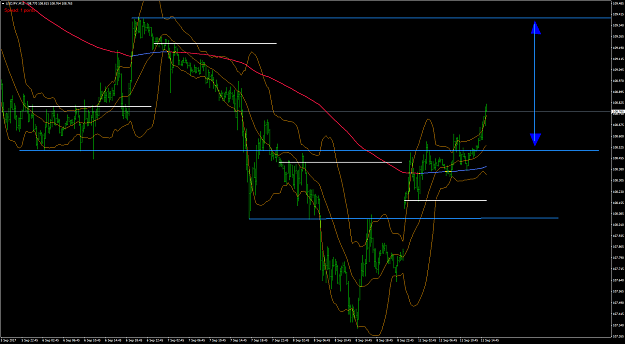

Keep an eye on major s/r (Be careful if your signal is at prev swing high/low.Here,a bit of Price action and price breakout knowledge is handy).

If in doubt, its always better to leave it and wait for a better opportunity. These opportunities will crop up dozens of times a day.

High impact news - Personally I stay out till its out of the way.

SL up to you.

Prev swing high/low is probably best.

Less is more !

That's it.

Good luck

Please note. I will not be sharing any of my personal trades (aside from illustration purposes) nor will I provide trading signals.

Your trades are your responsibility and yours alone.

I am simply sharing a trading technique that has been successful for me.

EDIT --

Nice add on developed and contributed by abokwaik. Makes entry opportunities easier to spot

Simple scalping. Thought I'd share the strategy I use.

Scalping suits me. I'd rather be out of the market more often than in it.

1 or 5 Min chart, Any pair, low spread.

Bollinger bands 25:2:Close

Smoothed MA 120 High

Smoothed MA 120 Low

The double MAs are handy when price is there. Stops you wondering where price is closing and gives a bit of a buffer.

Direction- BB ma in relation to main MAs

Sell off upper band TP lower band.

Vice versa for long

If market is sideways, still valid but better value when MAs start to trend.

Keep an eye on major s/r (Be careful if your signal is at prev swing high/low.Here,a bit of Price action and price breakout knowledge is handy).

If in doubt, its always better to leave it and wait for a better opportunity. These opportunities will crop up dozens of times a day.

High impact news - Personally I stay out till its out of the way.

SL up to you.

Prev swing high/low is probably best.

Less is more !

That's it.

Good luck

Please note. I will not be sharing any of my personal trades (aside from illustration purposes) nor will I provide trading signals.

Your trades are your responsibility and yours alone.

I am simply sharing a trading technique that has been successful for me.

EDIT --

Attached File(s)

Where price is now, it has been before, and will be again.