Few days before brexit i closed half my position and then, u all know what happened.

No regrets though as my MM was rightly executed.

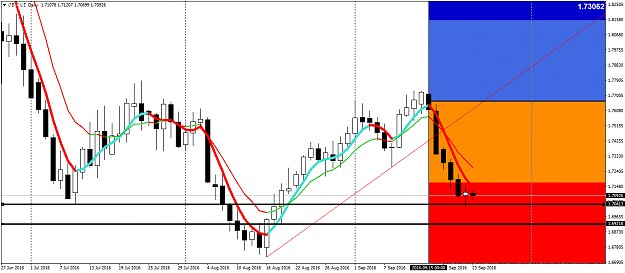

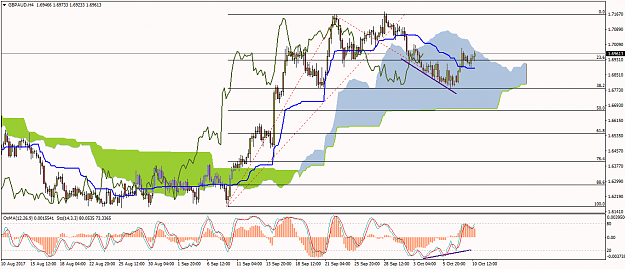

When the next retrace came above 1.76, i added more position and again closed some at the next leg down.

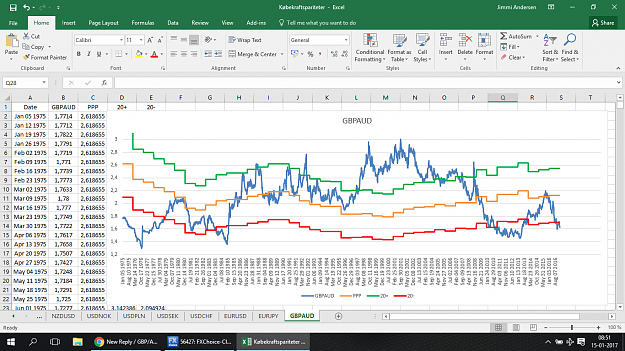

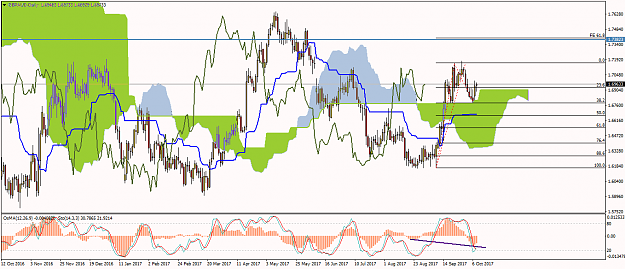

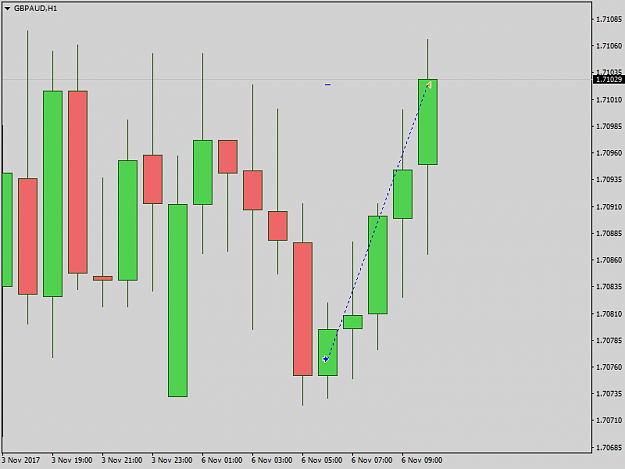

This time, again after RBA cut, unwinding of GBP positions, i added again at 1.74... but now i am not too sure. The breakdown of GBP should have resulted in another decent drop but the USD expectations pulled AUD down. The resulting rise in GBPAUD says AUD broke down more than GBP, making me rethink about GBP weakness...

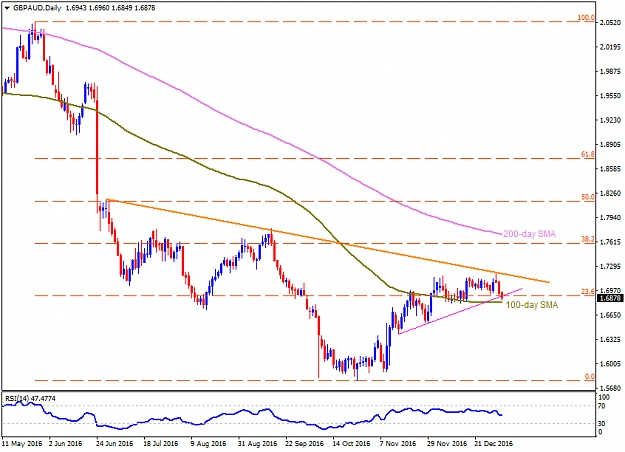

While my timing for past few months seem appropriate, i am thinking hard about the next few months before winter comes... Next RBA possible rate decision may come in Nov, and while i doubt they really want cut again with the housing market situation, i feel it is best to close most of my position by then.

I quoted this because my previous targets were 1.64 and 1.56.

Any comments?