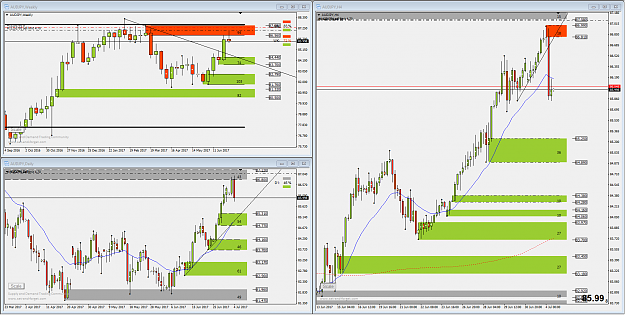

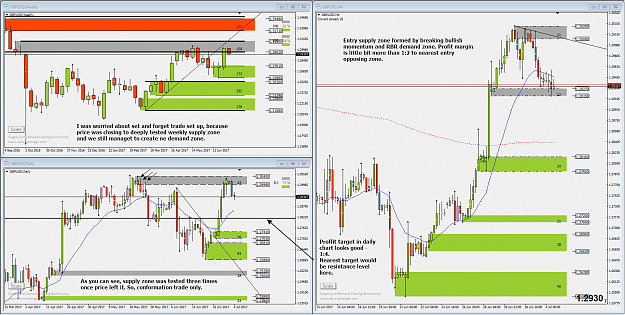

Disliked{quote} Hello tseann thank you for sharing your charts. Some thoughts to consider on the Euro best wishes{image}{image}Ignored

Thank you for your feedback.

For the momentum trendline I had on EURUSD Monthly wasn't valid as that one you circled is not a lower low? Is that that you mean? If it's a yes, I got it.

So we can consider that price has broken the momentum trendline you drew? Is that correct?

As for Weekly chart, I can see that you've the 2 demand zones and a supply zone that I don't have on my chart.

I'm still watching your webinar but I can spot that this EURUSD Weekly is kinda similar with AUDUSD Weekly right?

Best regards.