Borrowed from Schwager's Market Wizards book, a quote from the famed mutual fund switcher, Gil Blake:

ďIím not a big fan of diversification. My answer to that question is that you can diversify very well by just making enough trades per year. If the odds are 70 percent in your favor and you make fifty trades, itís very difficult to have a down year.Ē

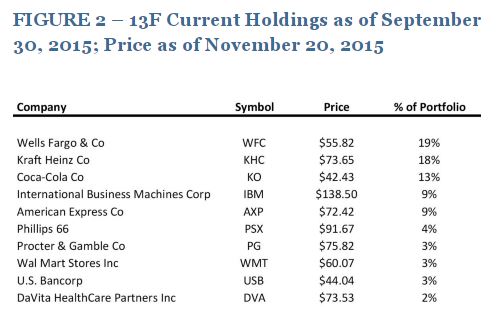

Also, Warren Buffett on diversification:

I live down the road from Buffett, so naturally enough I'm a huge fan. Buffett speaks hear about being careful to pull the trigger on investments, he says to looks for the great opportunities. To apply this to trading, the idea is the same, but should be stated differently. I see you fellas talking about diversification and trading different market conditions, in my opinion that's a mistake, especially the latter, there is really only one market condition that should be traded, and that is simply a market that's moving with conviction. So to restate Buffett's idea here, part of selecting really good trades is to simultaneously reject a whole lot of really bad trades--that is step # 1.

Part of the sickness in the trading world today is that all of us sitting behind computer screens never get to the real business of trading, when I say "Trading" in this context, think open outcry, face-to-face trading. In my mind, when I see people talking about things like trading sideways markets, I wonder to myself if there were traders in Chicago who sat in the same pit all the time and worked out how to win when all the money was off in other commodities. If there were such traders, I doubt they lasted very long, maybe I'm wrong.

ďIím not a big fan of diversification. My answer to that question is that you can diversify very well by just making enough trades per year. If the odds are 70 percent in your favor and you make fifty trades, itís very difficult to have a down year.Ē

Also, Warren Buffett on diversification:

Inserted Video

I live down the road from Buffett, so naturally enough I'm a huge fan. Buffett speaks hear about being careful to pull the trigger on investments, he says to looks for the great opportunities. To apply this to trading, the idea is the same, but should be stated differently. I see you fellas talking about diversification and trading different market conditions, in my opinion that's a mistake, especially the latter, there is really only one market condition that should be traded, and that is simply a market that's moving with conviction. So to restate Buffett's idea here, part of selecting really good trades is to simultaneously reject a whole lot of really bad trades--that is step # 1.

Part of the sickness in the trading world today is that all of us sitting behind computer screens never get to the real business of trading, when I say "Trading" in this context, think open outcry, face-to-face trading. In my mind, when I see people talking about things like trading sideways markets, I wonder to myself if there were traders in Chicago who sat in the same pit all the time and worked out how to win when all the money was off in other commodities. If there were such traders, I doubt they lasted very long, maybe I'm wrong.