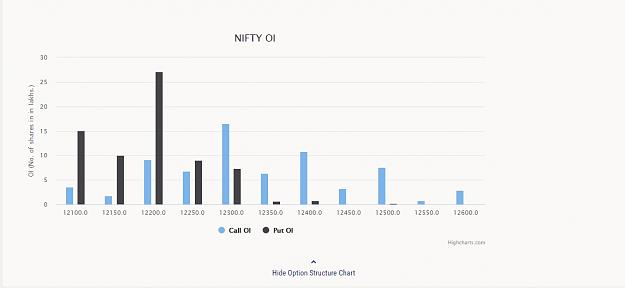

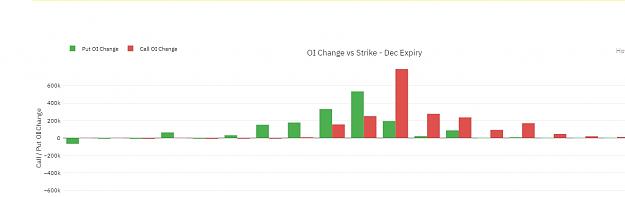

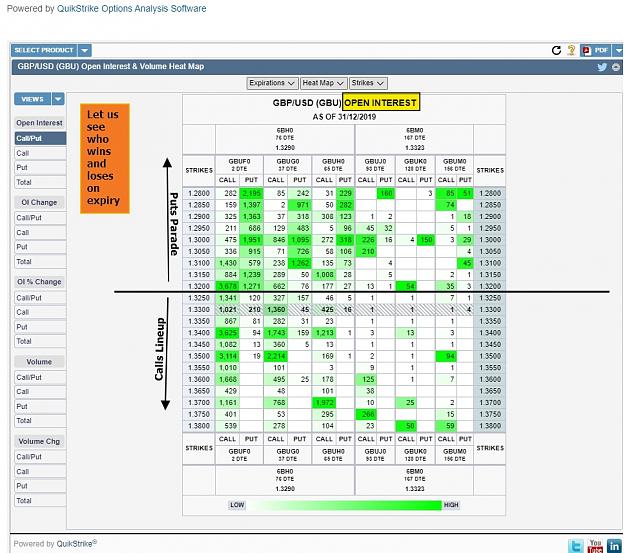

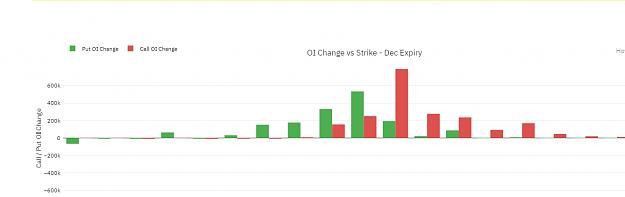

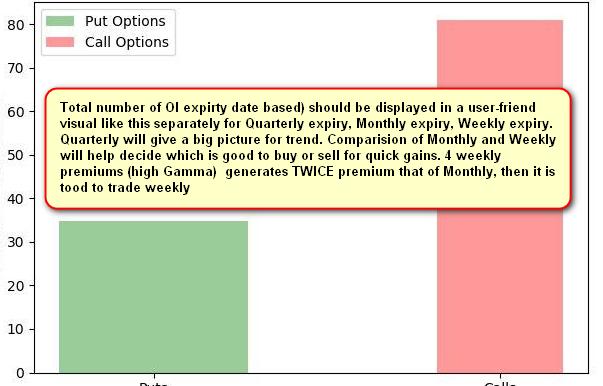

Open Interest is known to be the best tool for analysing option activity.

Does it reflect what option traders are doing on a given day?

Can we construe large volume as an indicator of day-trading activity?

How do we use Volume or Open Interest to identify whether the market is turning bearish or bullish?

Who actually is the primary driver of option trades? Is it the seller or the buyer?

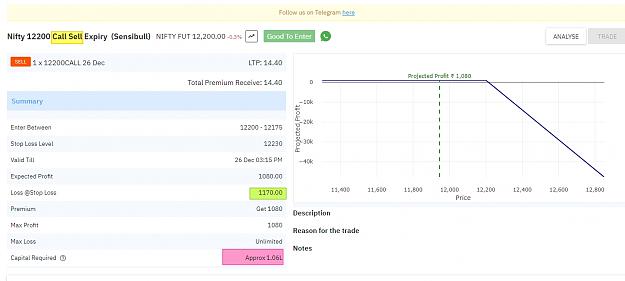

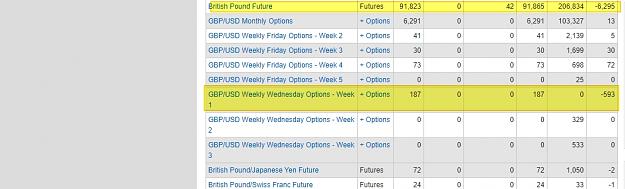

I am looking for answers to these questions because short-dated options like weeklies and b-weeklies facilitate day-trading of options .

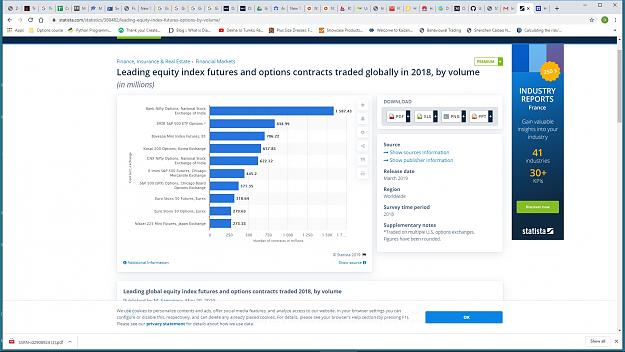

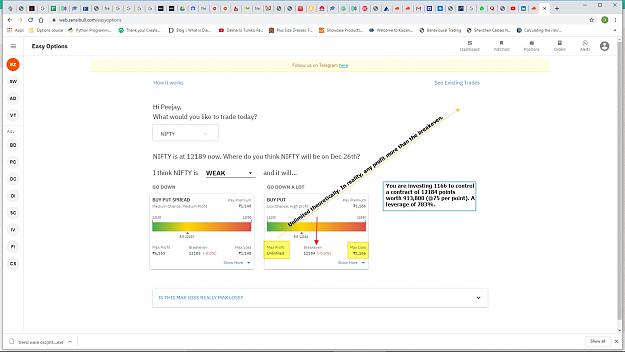

Options encompasses the whole world of derivatives and gives a skillful day trader to a chance to make money from a small account.

Buying is simple and I prefer to stick to it.

It is like sports betting.

I bet on Bulls or Bears. My wins (80%) should nett me 2,000 per cent gains in a year and losses (20%) should not take away from me more than 1,000% leaving with me a profit of 1000%.

Can Open Interest help me in achieving it?

I hope experienced trades can share their views on the effectiveness of Open Interest and provide sources for tools.

Does it reflect what option traders are doing on a given day?

Can we construe large volume as an indicator of day-trading activity?

How do we use Volume or Open Interest to identify whether the market is turning bearish or bullish?

Who actually is the primary driver of option trades? Is it the seller or the buyer?

I am looking for answers to these questions because short-dated options like weeklies and b-weeklies facilitate day-trading of options .

Options encompasses the whole world of derivatives and gives a skillful day trader to a chance to make money from a small account.

Buying is simple and I prefer to stick to it.

It is like sports betting.

I bet on Bulls or Bears. My wins (80%) should nett me 2,000 per cent gains in a year and losses (20%) should not take away from me more than 1,000% leaving with me a profit of 1000%.

Can Open Interest help me in achieving it?

I hope experienced trades can share their views on the effectiveness of Open Interest and provide sources for tools.

Practice makes a person perfect