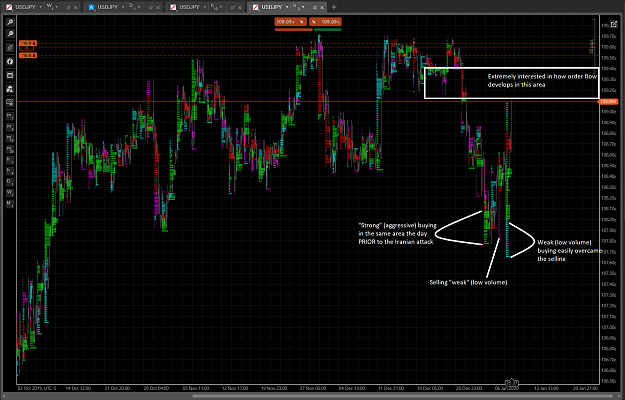

Disliked{quote} Thank you for the vote of confidence. I am now seeing a bit of a stop out on the shorts but far weaker than I expected it might be. Of course the day isn't over yet and the US session has just begun. So I'll have to see what this looks like at the end of the NY session. However I suspect another "stab" at the lows before things skyrocket. {image}Ignored

... as i understand the colors of your delta profile: Green bars mean heavy Ask volume & Red bars mean heavy Bid volume, am I correct, just simple like that or something else?

what does the Magenta & the SkyBlue bars mean please?

Good Day all!

positive interest or negative interest?

1