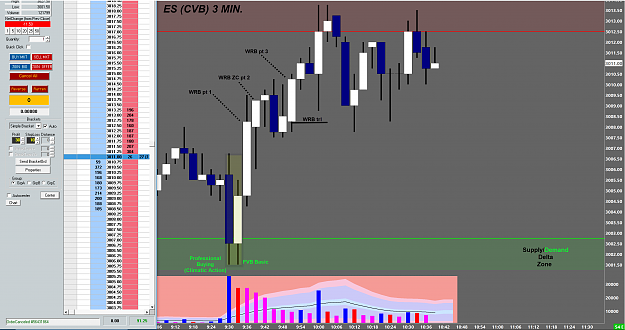

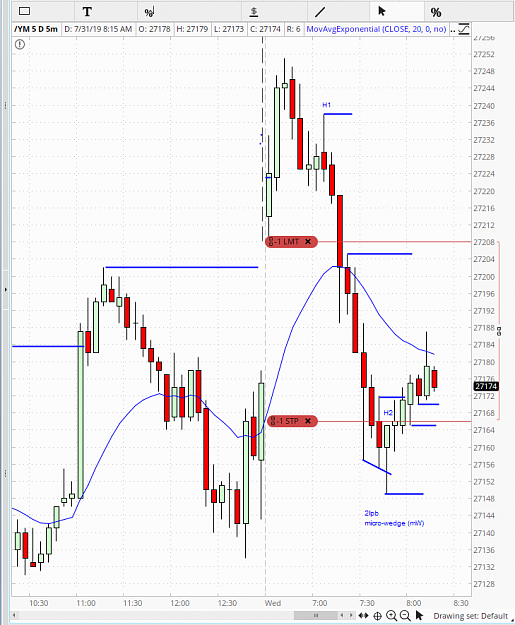

This thread will be to discuss active intraday trading of the US index futures (S&P, Dow, Nasdaq). I am getting back into the game after some time off and trying to focus on aggressively building size in a small account which means accurate entries with reasonable stops and reward that is at least 2x the risk, and most importantly, remaining disciplined to only take my setups and respect my stops.

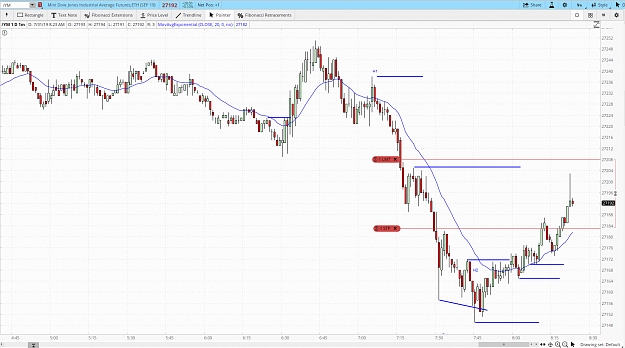

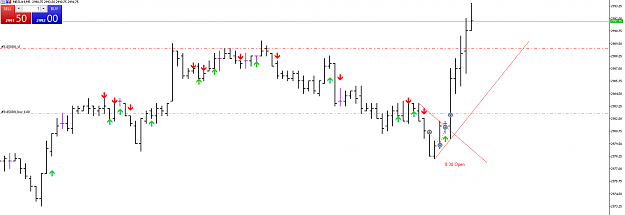

I'll share components of my system as I go along, feel free to do the same, but I primarily trade 5 minute charts for the first 2.5 hours after the US open. Occasionally, I will drop down to a 1 minute chart during the first half hour after open. Brooks' work has the dominant influence on my system most evident in my division of market actions into two legs. I'm not looking to persuade anyone about my trading ideas, nor be persuaded by others, but all systems/analysis are welcome.

I was keeping a blog for myself to monitor my quest, but its lonely and hopefully we can get some interaction here. I also figure posting here will keep me from doing anything too-boneheaded (like adding incessantly to losing trades).

I'll share components of my system as I go along, feel free to do the same, but I primarily trade 5 minute charts for the first 2.5 hours after the US open. Occasionally, I will drop down to a 1 minute chart during the first half hour after open. Brooks' work has the dominant influence on my system most evident in my division of market actions into two legs. I'm not looking to persuade anyone about my trading ideas, nor be persuaded by others, but all systems/analysis are welcome.

I was keeping a blog for myself to monitor my quest, but its lonely and hopefully we can get some interaction here. I also figure posting here will keep me from doing anything too-boneheaded (like adding incessantly to losing trades).

Small disciplines repeated with consistency lead to great achievements.