Ultimate Scalping & Market Profile

Major change: I have created another thread, that covers all I've done until now and delivers a more convenient way to trade:

https://www.forexfactory.com/showthread.php?t=938414

Very often we hear, that with mt4 it is impossible to trade the market via Volume Analysis or Market Profile.

So, is that really true?!

As you can see by statistics, the largest CFD forex brokers - ICMarkets, Forex.com, XM, SaxoBank, Oanda and Exness - already have a cumulated average volume of 80 billion US Dollar each day. Other CFD brokers cover together about 90 billion US Dollar.

So we talk about an average volume of 170 billion US dollar transactions, each day!

Source: http://www.wvwv.org/forex-brokers/la...x-brokers.html

Shall we really let this pass us by, or shouldn't we try to analyze it to gather some input for our trading strategy?!

This is what this thread will be about...

Ultimate Scalping:

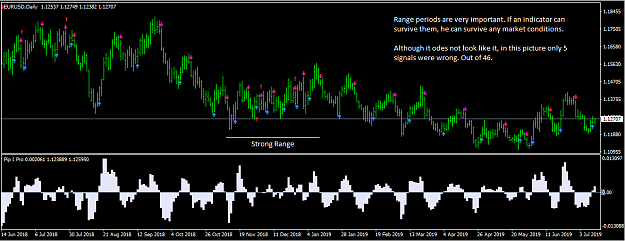

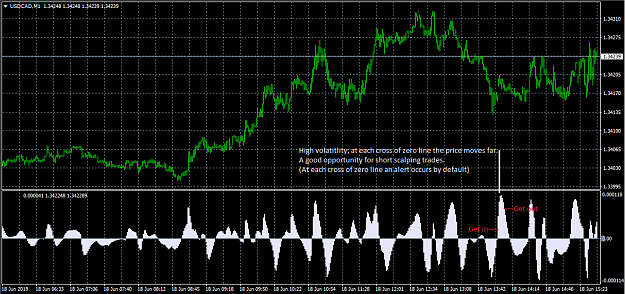

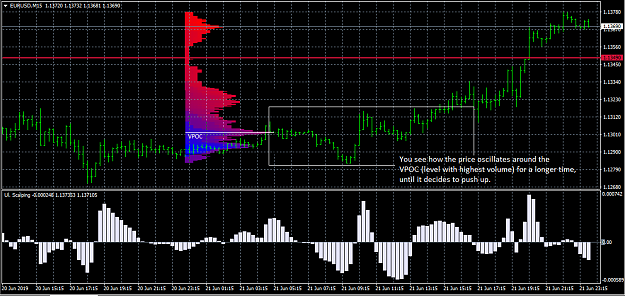

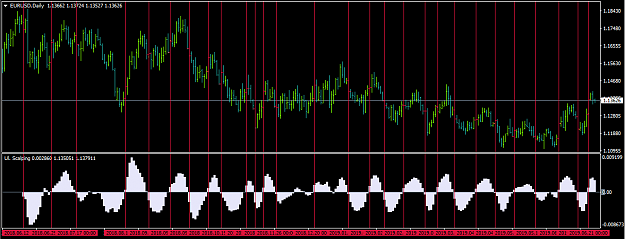

But first, have a look at my scalping indicator, which will help us in near future to trade the Market Profile:

- Adjustable Periods must have a higher value than Fixed Periods; please make sure to set Flat Filter to true -

New version:

Attached File(s)

Adj Periods 8, Fixed Periods 3, Flat = true

Old version:

Attached File(s)

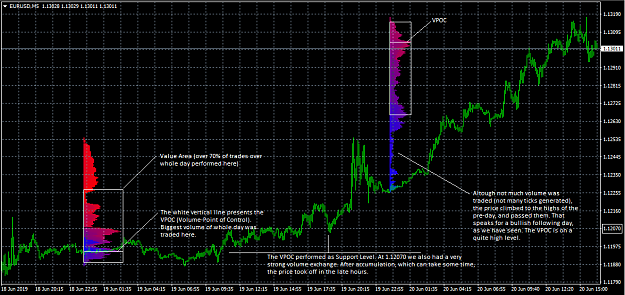

Market & Cluster Profile:

- A new Market Profile indicator, that depends on real ticks, will be uploaded shortly -

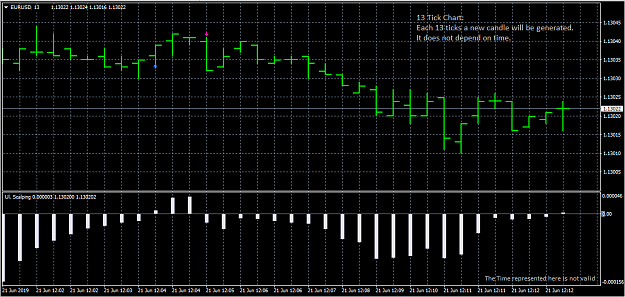

Tick Chart Indicator:

When you activate the indicator, a new chart-window is being opened. Do not close the original chart you activated the indicator on; it needs to remain open.

You can activate other indicators on the tick chart, for ex. the Ultimate Scalping.

Attached File(s)

Additional Indicators:

Auto Trendline Drawing indis:

Attached File(s)

Support and Resistance indis:

Attached File(s)

Currency Strength Meter indis:

Attached File(s)

Make sure to have enough historical data in your mt4 to have the indicators working correctly.

More about to come...

Check page 1 for all infos...