Hello All, I want to start a rather controversial thread here! This is my first thread and I consider myself a Junior trader. So it is a free for all thread. All I ask is do not flame people here, if this topic sickens you, please move on, no need to bring noncontributory comments that I will quickly frown upon or I will use my veto power to end you.

Please read to the end before you draw conclusions with your advanced trading theories. We are all here to learn mostly from those that went before us, not for them to rain fire on us.

I am a fan of Risk Management, special notes on position sizing and RRR (Reward to Risk Ration). Now this thread will go out of the way of normal trading as it border more on betting! Example, sport/lottery betting give as high as >=1,000 RRR. This is almost impossible on real trading, or I think so? This is the reason for this thread. Finding such crazy return system and refining it.

Some of us do bet on sport, I don't and I have been telling my wife I will rather be trading sport betting, let me explain. I think of it as a Distribution curve outlier system. Where the chances of hitting a trade/bet of 1,000RRR is at the tail, very very very rare. I think with trading we have a better chance as at least we will have a system trying to exploit an observed market tendency when sport betting is well, just guesswork.

Using trading knowledge, souped with betting tint, let's look at an example;

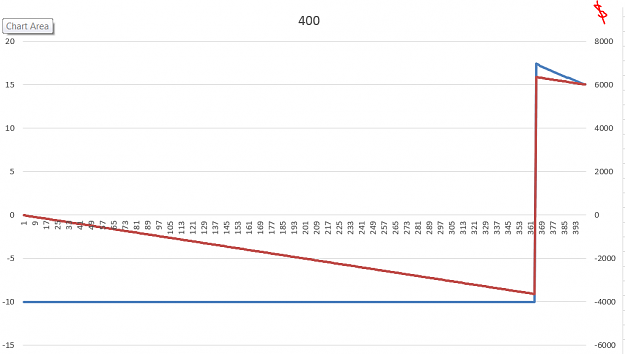

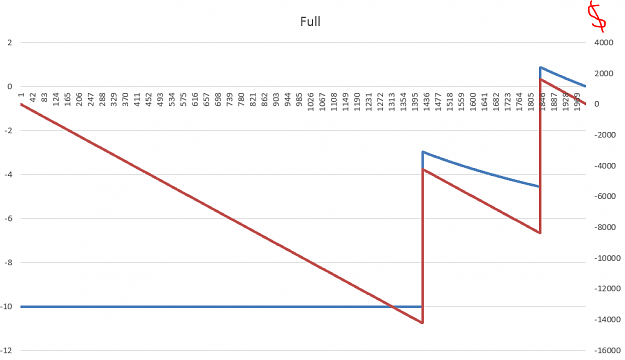

Say I finally find a market tendency to exploit for 1,000RRR, but has a very low win rate of 0.2-0.5%, that is 99.5 to 99.8% of trades you take are going to be losses.

Key Points;

1. To balance the account for recovery, we use a fixed amount allocation for position sizing not variable fixed percentage allocation.

2. This system will have to be automated so that there will be no execution error or second guessing trades, after all, how many people can trade a system with 99.5% loss rate with their emotions still intact?

3. Important point here is, will you even win any trade? Statistically, every trade has same equal chance of either win rate of 0.2% to loss rate of 99.8%.

4. This will never be your regular trading system, except you want to be homeless. Think of this as a side project, that can make you lottery rich if it works!

Note; in reference to point #1, I know that fixed percentage allocation will give the account an unlimited tries but given the win rate, it is going to be a slow death, more like death by a thousand paper cuts. Even if it wins 1 trade, I do not think the recovery will be worth it, maybe I am wrong!

Ok, so I factor I will likely win at least 1 trade out of say 500, that is win rate of 0.2%. So say my deposit capital is USD10,000, using fixed amount allocation, that is USD10,000 / 500 = USD20 per trade. Say I run this system, first 475 trades are losses, then an outlier occurs I win the 476th trade with 1,000 RRR. lets do the maths,

. As at this win, I still have some cash left from original capital; 500 chances - 476th trade = 24 chances left * USD20 = USD480.

. Winnings from 476th trade = USD20 * 1,000 = USD20,000

. TOTAL Gross Gain(Not counting trading cost, taxes, etc) = USD20,480.00

This is just educational, to ping ideas... I need your contributions...is there even a market tendency to exploit for 1,000 RRR?

Please read to the end before you draw conclusions with your advanced trading theories. We are all here to learn mostly from those that went before us, not for them to rain fire on us.

I am a fan of Risk Management, special notes on position sizing and RRR (Reward to Risk Ration). Now this thread will go out of the way of normal trading as it border more on betting! Example, sport/lottery betting give as high as >=1,000 RRR. This is almost impossible on real trading, or I think so? This is the reason for this thread. Finding such crazy return system and refining it.

Some of us do bet on sport, I don't and I have been telling my wife I will rather be trading sport betting, let me explain. I think of it as a Distribution curve outlier system. Where the chances of hitting a trade/bet of 1,000RRR is at the tail, very very very rare. I think with trading we have a better chance as at least we will have a system trying to exploit an observed market tendency when sport betting is well, just guesswork.

Using trading knowledge, souped with betting tint, let's look at an example;

Say I finally find a market tendency to exploit for 1,000RRR, but has a very low win rate of 0.2-0.5%, that is 99.5 to 99.8% of trades you take are going to be losses.

Key Points;

1. To balance the account for recovery, we use a fixed amount allocation for position sizing not variable fixed percentage allocation.

2. This system will have to be automated so that there will be no execution error or second guessing trades, after all, how many people can trade a system with 99.5% loss rate with their emotions still intact?

3. Important point here is, will you even win any trade? Statistically, every trade has same equal chance of either win rate of 0.2% to loss rate of 99.8%.

4. This will never be your regular trading system, except you want to be homeless. Think of this as a side project, that can make you lottery rich if it works!

Note; in reference to point #1, I know that fixed percentage allocation will give the account an unlimited tries but given the win rate, it is going to be a slow death, more like death by a thousand paper cuts. Even if it wins 1 trade, I do not think the recovery will be worth it, maybe I am wrong!

Ok, so I factor I will likely win at least 1 trade out of say 500, that is win rate of 0.2%. So say my deposit capital is USD10,000, using fixed amount allocation, that is USD10,000 / 500 = USD20 per trade. Say I run this system, first 475 trades are losses, then an outlier occurs I win the 476th trade with 1,000 RRR. lets do the maths,

. As at this win, I still have some cash left from original capital; 500 chances - 476th trade = 24 chances left * USD20 = USD480.

. Winnings from 476th trade = USD20 * 1,000 = USD20,000

. TOTAL Gross Gain(Not counting trading cost, taxes, etc) = USD20,480.00

This is just educational, to ping ideas... I need your contributions...is there even a market tendency to exploit for 1,000 RRR?