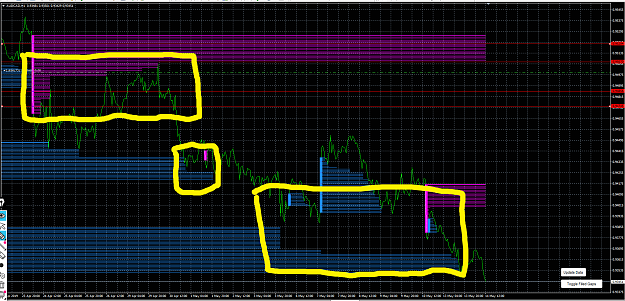

DislikedI have a question re. using liquidity gaps (LG) as targets. First chart below shows an LG on H4 (GBPUSD) between 08:00 and 16:00 bars on May 7th. The second chart shows two different LGs on H1 between the same time period as H4. Consider we are looking at charts at 16:00 on the same day and we have a long position. What would be our target in terms of LGs as different time frames show different targets? If someone checks M15, I am sure there will be different target levels of LGs. As entries are from M1, which time frame do we need to use to determine...Ignored

If you could choose one particular liquidity gap, zoom-in on M15, H1, H4 time frames, then I would expect to find the same gap in all 3. It might also be that what you think is a gap is not really a gap.

2