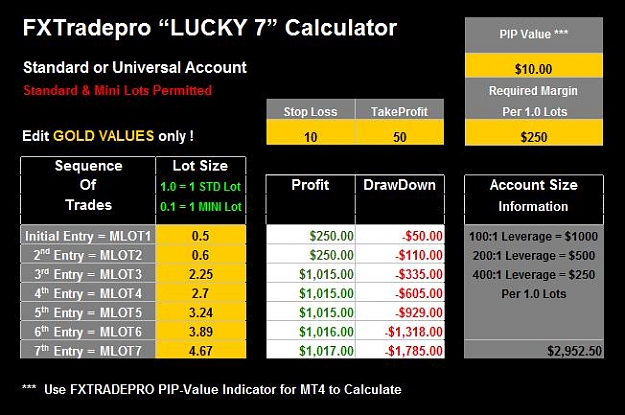

I will be keeping a Journal of my Trade Results using the FXTradepro "Lucky 7" Set-Up, which is based upon the Method I detailed in a previous Thread here at Forex Factory.

FXTradepro: Strategy using a “Semi-Martingale” Position Sizing

FXTradepro: Strategy using a “Semi-Martingale” Position Sizing