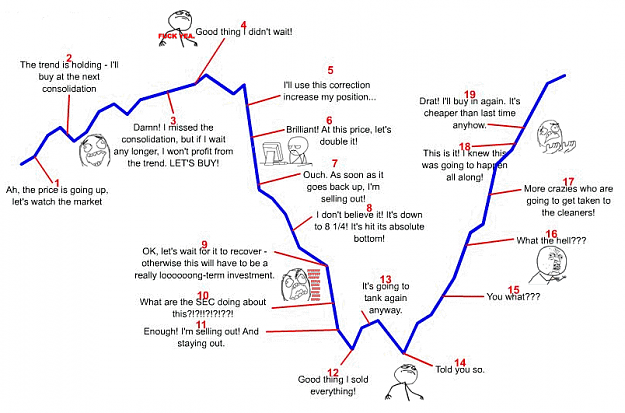

I'm tired of losing money on Forex!

I have no savings left and I have problems in the family.

I'm tired of using technical indicators and moving averages, fundamental newa, patterns and levels of support and resistance, trend following, market profile, volume analysis, COT reports, options analysis! Everything Sucks!

Now I'm trying to understand and use cause and effect methods like Volume Spread Analysis and Locked-in Range Analysis. And I understand again that I did everything wrong before. I undestand that I was a Lucky-trader.

I like cause and effect trading and want to try it.

Do you know Cause & Effect Trading Strategies?

I have no savings left and I have problems in the family.

I'm tired of using technical indicators and moving averages, fundamental newa, patterns and levels of support and resistance, trend following, market profile, volume analysis, COT reports, options analysis! Everything Sucks!

Now I'm trying to understand and use cause and effect methods like Volume Spread Analysis and Locked-in Range Analysis. And I understand again that I did everything wrong before. I undestand that I was a Lucky-trader.

I like cause and effect trading and want to try it.

Do you know Cause & Effect Trading Strategies?