Hundreds of threads on the same topic, thousands of posts and millions of discussions here on FF and lot of experts had already proved many times that Martingale, Grid and Hedge systems will never work in the long run unless one has huge capital in his bank. But still, there are many traders (maybe day-dreamers  ) who believe that these systems can work in reality even with low capital and proper Money Management.

) who believe that these systems can work in reality even with low capital and proper Money Management.

Possible? Well, I am one of those day-dreamers who believe this is possible despite already lost so much money in this. We all are well aware that by using any system, we cannot turn our 100 or 500 bucks into millions but in my opinion, we can generate decent monthly income using such automated systems. I am not here to claim that I found a martingale and hedge holy grail and want to sell it to you guys. Not at all.

Since a year, I am continuously following every thread here on FF which is related to Martingale, Grid and Hedge because simply I love these systems (or because I don't know how to trade or don't have time at all for manual trade). Most of the threads are dead already and most of the people have left hope in such systems. But maybe there are some successful traders who are already trading such systems on real account and making good pips and not disclosing here.

or don't have time at all for manual trade). Most of the threads are dead already and most of the people have left hope in such systems. But maybe there are some successful traders who are already trading such systems on real account and making good pips and not disclosing here.

Anyway, I want to share a simple Martingale + Hedge EA; there is nothing unique in this and you can find on internet hundreds, if not thousands, martingale EA's similar to this. So why should we try this? Because it has fewer ingredients of greed and worth to try once at least.

Since my last account stopped out with blast last year by a martingale EA, I kept thinking what could have saved that account. Maybe hedging? I requested coder (from whom I purchased that EA) to make some necessary changes and add few parameters but he refused to do so. So recently I hired another coder to build this EA as per my own requirements. He did a really wonderful job.

Strategy:

Kindly see attached excel sheet for the details of the strategy. This is not a unique one, a lot of EA's available over the internet with similar strategies. We know that Martingale is best for ranging and trend or spike kills it. So to give some extra life to martingale, I thought to try hedge in crucial moments. Last year, I was using martingale EA Quanttec with the very dangerous setting; Distance 10 pips and Multiplier 2 which was not changeable parameter (I wish I backtested that EA before going live because at that time, I was not a believer of BT). Anyhow, with 5000$ deposit, EA was able to survive a spike of maximum 150 pips without retracement but one day I survived 220+ pips on GBPUSD because I was in front of the system and I used hedge for high lot trades and closed as soon as 1st H1 bar of London session completed. The price moved to the opposite direction and martingale cycle closed. But on another day, my account stopped out because EURJPY got mad without any major news and moved 180+ pips and I was not there in front of the system (I was driving to the office and saw the live crash on my mobile and could do nothing about that.)

Once your martingale EA is near to crash your account, either you may save it by additional deposit or hedge. No one will risk additional deposit at that stage so i started searching for most hedge friendly broker and found one which offers Zero Hedge Margin. I wanted a Martingale EA with hedge function at a crucial stage, I thought a lot about this and just started with this strategy (attached here) which is not perfect yet but at least can provide us a start to make improvement. With this strategy, if you are using hedge friendly broker and you have enough deposit to bear spread the cost, you can survive spike of 750+ pips even but this will fail if price stuck in range after hitting crucial hedge level. Mostly, when price moves in one direction for 300+ or 500+ pips then it retraces for 100+ pips at least. If this happens, then this EA will survive with minimum losses.

I know, most of the expert traders will say, this way of hedging is really foolish and stupid idea to save martingale but I believe, this can work, only we need to find the best setting for engine 2 or improve its parameters.

EA has 2 Engines;

Engine 1 only made to collect pips from both directions. As soon as EA starts, Engine 1 start grabbing pips whatever is the market direction. It works best in ranging. Engine 2 is bouncer or security guard for Engine 1. Once Engine 1 reaches risk level, Engine 2 steps in to Hedge and gives extra life to EA. Once price become friendly, Engine 2 will sleep again but again wakes up (reborn) if required. This Engine 2 is basically first defense line but its not perfect. I need ideas and help from you guys, how to make it more strong. Should we add more parameters or should add some extra defense via Engine 3? My email ID is available in EA parameters to reach me.

Engine 1 (Martingale):

This is purely martingale engine and you all know the settings parameters very well. These are; initial lot size, grid distance, multiplier, maximum lot size, allowed spread, take profit etc. New trades will keep opening using multiplier at every grid level and cycle will close by either profit with enough price retracement or account blowup (or account locking)

Engine 2 (Hedge):

Hedge Level: The grid level from where you want a hedge trade in place. Hedge trade will cover all open martingale trades. For example if total lot size of all martingale trades is 7.6 lot then a single hedge trade of 7.6 lot will open. (but if you chose 5.12 in Max Lot for Engine 2, then only 5.12 hedge trade will be placed). So here you can chose, you want to hedge completely or only few trades. Hedge trade can be closed either hitting SL or TP.

Trailing Stop-loss: This is for hedge trades only. As soon, as price will make given pips retracement, Hedge Trade will hit TSL (at profit or loss)

Trailing Step: After how many pips, trailing stop-loss should modify.

Stop-loss: This is also for hedge trades only. If you keep it low, it will hit again and again with smaller losses but if you will increase the value then it will hit lesser times but with greater losses.

Hedge Reborn: Your hedge trade already hit SL or Trailing SL and price start moving again against martingale trades then you may need hedge trade again to save your account. Here also you have option to completely hedge all trades or partially hedge by using Max Lot Size for Engine 2. The larger the size will be for this hedge trade, the more defense it will provide against martingale but in case of bad luck, if this hedge trade hit SL, the more bigger losses you will see.

Risk of this EA

Volatility/Red News/Spikes are not so dangerous for this EA but the most dangerous phase is range once Hedge Level started. If price stuck in range, hedge trades will keep hitting SL and then will keep opening and closing unless you will run out of equity.

NOT RECOMMENDED TO RUN THIS ON REAL ACCOUNT.

===================================

If you still want to trade on real at your own risk then;

*Start with minimum 5000$ on standard or 50$ on cent account

*Start with lot 0.01 (all default setting)

*Avoid Major Red News. Stop the EA 30 minutes before the news and close all open trades

*Resume the EA after 1 hour of Major Red News

*Trade only one pair EURUSD

*Account leverage must be 1:500 or more

*Withdraw your profits weekly/monthly

*Enter maximum $ amount in account locking setting which you can afford to lose

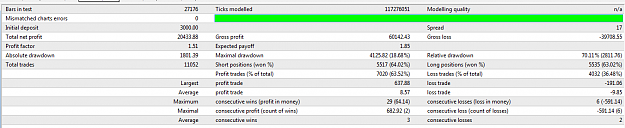

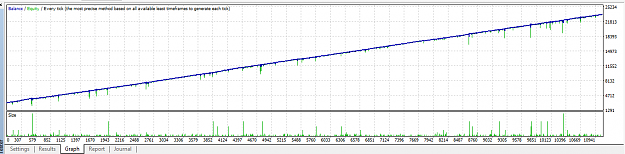

I have got really good back testing results from last 4 years tick data on EURUSD. (a smooth curve - dream of every trader). Back tests of one user is not enough to prove success of any EA so I need help of you guys to back test this on your historical data, and on demo as well. Lets see if we find any flaws then we can make it more safer and better because coder is really supportive and willing to make changes if required.

Details of my back testing:

To see step by step procedure, please visit here.

In my back tests, you will see "Modeling Quality" n/a instead of 99.9% but it doesn't matter as I have full green line and 0 mismatched chart errors. To get 99.9%, you need to purchase latest version of Tickstory and then open MT4 terminal from inside Tickstory. I exported with manual procedure, why should I pay to get this number only when results are same.

MyFxBook

I have placed this EA on VPS Demo Account with initial deposit of 3000 Euro (leverage 1:500) and you can check results here.

Back Test Results

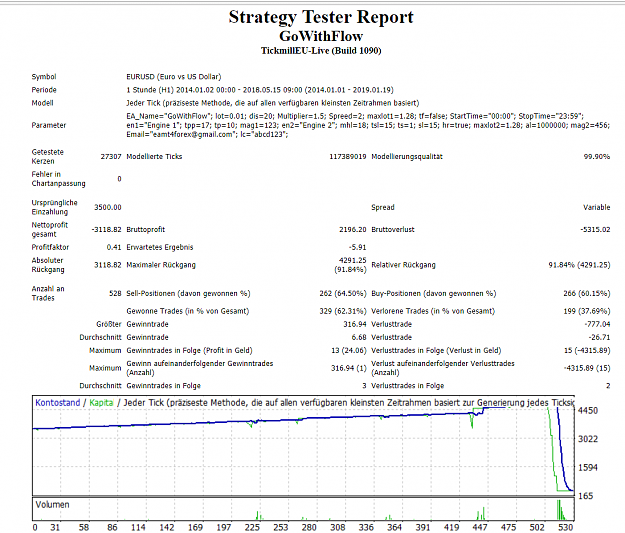

Here are my Back Testing Results with 99.9% Modeling Quality Tick Data.

Broker: XM (Standard Account)

Leverage: 1:500

Pair: EURUSD

Initial Deposit: 3000 Euro

Date Range: Jan 1, 2014 till May 13, 2018

Setting: Default Setting

Also you can see back test results of GBPUSD here.

===========================================================

Update: 13-08-2018

Received emails from lot of members requesting for code of this EA. Here you go friends; make experiment with it and do share good results in case you find better setting, add some better engine to improve profitability and to reduce DD. Thanks

===========================================================

Update: 11-10-2018

Added Investor Account Details for anyone who is interested to see current trades and trades history. Here you can see screen shot of setting which I am using for all 3 pairs in my demo account.

===========================================================

Update: 15-11-2018

I believe 6 months demo testing is enough to reveal the bugs and loop holes of this version. I have stopped my demo VPS account because needed the slot for testing of some other EA.

===========================================================

Update: 12-09-2019

I tried this EA on Real Cent account for a week and came to know that this EA is not working as per given strategy (excel sheet) and it was really badly coded. So I would not recommend any one to use this on real account.

===========================================================

Update: 16-05-2020

Most of the users were not able to change expiry date in mq4 file, so I uploaded a revised file with expiry date 31-12-2040.

Possible? Well, I am one of those day-dreamers who believe this is possible despite already lost so much money in this. We all are well aware that by using any system, we cannot turn our 100 or 500 bucks into millions but in my opinion, we can generate decent monthly income using such automated systems. I am not here to claim that I found a martingale and hedge holy grail and want to sell it to you guys. Not at all.

Since a year, I am continuously following every thread here on FF which is related to Martingale, Grid and Hedge because simply I love these systems (or because I don't know how to trade

Anyway, I want to share a simple Martingale + Hedge EA; there is nothing unique in this and you can find on internet hundreds, if not thousands, martingale EA's similar to this. So why should we try this? Because it has fewer ingredients of greed and worth to try once at least.

Since my last account stopped out with blast last year by a martingale EA, I kept thinking what could have saved that account. Maybe hedging? I requested coder (from whom I purchased that EA) to make some necessary changes and add few parameters but he refused to do so. So recently I hired another coder to build this EA as per my own requirements. He did a really wonderful job.

Strategy:

Kindly see attached excel sheet for the details of the strategy. This is not a unique one, a lot of EA's available over the internet with similar strategies. We know that Martingale is best for ranging and trend or spike kills it. So to give some extra life to martingale, I thought to try hedge in crucial moments. Last year, I was using martingale EA Quanttec with the very dangerous setting; Distance 10 pips and Multiplier 2 which was not changeable parameter (I wish I backtested that EA before going live because at that time, I was not a believer of BT). Anyhow, with 5000$ deposit, EA was able to survive a spike of maximum 150 pips without retracement but one day I survived 220+ pips on GBPUSD because I was in front of the system and I used hedge for high lot trades and closed as soon as 1st H1 bar of London session completed. The price moved to the opposite direction and martingale cycle closed. But on another day, my account stopped out because EURJPY got mad without any major news and moved 180+ pips and I was not there in front of the system (I was driving to the office and saw the live crash on my mobile and could do nothing about that.)

Once your martingale EA is near to crash your account, either you may save it by additional deposit or hedge. No one will risk additional deposit at that stage so i started searching for most hedge friendly broker and found one which offers Zero Hedge Margin. I wanted a Martingale EA with hedge function at a crucial stage, I thought a lot about this and just started with this strategy (attached here) which is not perfect yet but at least can provide us a start to make improvement. With this strategy, if you are using hedge friendly broker and you have enough deposit to bear spread the cost, you can survive spike of 750+ pips even but this will fail if price stuck in range after hitting crucial hedge level. Mostly, when price moves in one direction for 300+ or 500+ pips then it retraces for 100+ pips at least. If this happens, then this EA will survive with minimum losses.

I know, most of the expert traders will say, this way of hedging is really foolish and stupid idea to save martingale but I believe, this can work, only we need to find the best setting for engine 2 or improve its parameters.

EA has 2 Engines;

Engine 1 only made to collect pips from both directions. As soon as EA starts, Engine 1 start grabbing pips whatever is the market direction. It works best in ranging. Engine 2 is bouncer or security guard for Engine 1. Once Engine 1 reaches risk level, Engine 2 steps in to Hedge and gives extra life to EA. Once price become friendly, Engine 2 will sleep again but again wakes up (reborn) if required. This Engine 2 is basically first defense line but its not perfect. I need ideas and help from you guys, how to make it more strong. Should we add more parameters or should add some extra defense via Engine 3? My email ID is available in EA parameters to reach me.

Engine 1 (Martingale):

This is purely martingale engine and you all know the settings parameters very well. These are; initial lot size, grid distance, multiplier, maximum lot size, allowed spread, take profit etc. New trades will keep opening using multiplier at every grid level and cycle will close by either profit with enough price retracement or account blowup (or account locking)

Engine 2 (Hedge):

Hedge Level: The grid level from where you want a hedge trade in place. Hedge trade will cover all open martingale trades. For example if total lot size of all martingale trades is 7.6 lot then a single hedge trade of 7.6 lot will open. (but if you chose 5.12 in Max Lot for Engine 2, then only 5.12 hedge trade will be placed). So here you can chose, you want to hedge completely or only few trades. Hedge trade can be closed either hitting SL or TP.

Trailing Stop-loss: This is for hedge trades only. As soon, as price will make given pips retracement, Hedge Trade will hit TSL (at profit or loss)

Trailing Step: After how many pips, trailing stop-loss should modify.

Stop-loss: This is also for hedge trades only. If you keep it low, it will hit again and again with smaller losses but if you will increase the value then it will hit lesser times but with greater losses.

Hedge Reborn: Your hedge trade already hit SL or Trailing SL and price start moving again against martingale trades then you may need hedge trade again to save your account. Here also you have option to completely hedge all trades or partially hedge by using Max Lot Size for Engine 2. The larger the size will be for this hedge trade, the more defense it will provide against martingale but in case of bad luck, if this hedge trade hit SL, the more bigger losses you will see.

Risk of this EA

Volatility/Red News/Spikes are not so dangerous for this EA but the most dangerous phase is range once Hedge Level started. If price stuck in range, hedge trades will keep hitting SL and then will keep opening and closing unless you will run out of equity.

NOT RECOMMENDED TO RUN THIS ON REAL ACCOUNT.

===================================

If you still want to trade on real at your own risk then;

*Start with minimum 5000$ on standard or 50$ on cent account

*Start with lot 0.01 (all default setting)

*Avoid Major Red News. Stop the EA 30 minutes before the news and close all open trades

*Resume the EA after 1 hour of Major Red News

*Trade only one pair EURUSD

*Account leverage must be 1:500 or more

*Withdraw your profits weekly/monthly

*Enter maximum $ amount in account locking setting which you can afford to lose

I have got really good back testing results from last 4 years tick data on EURUSD. (a smooth curve - dream of every trader). Back tests of one user is not enough to prove success of any EA so I need help of you guys to back test this on your historical data, and on demo as well. Lets see if we find any flaws then we can make it more safer and better because coder is really supportive and willing to make changes if required.

Details of my back testing:

To see step by step procedure, please visit here.

In my back tests, you will see "Modeling Quality" n/a instead of 99.9% but it doesn't matter as I have full green line and 0 mismatched chart errors. To get 99.9%, you need to purchase latest version of Tickstory and then open MT4 terminal from inside Tickstory. I exported with manual procedure, why should I pay to get this number only when results are same.

MyFxBook

I have placed this EA on VPS Demo Account with initial deposit of 3000 Euro (leverage 1:500) and you can check results here.

Back Test Results

Here are my Back Testing Results with 99.9% Modeling Quality Tick Data.

Broker: XM (Standard Account)

Leverage: 1:500

Pair: EURUSD

Initial Deposit: 3000 Euro

Date Range: Jan 1, 2014 till May 13, 2018

Setting: Default Setting

Also you can see back test results of GBPUSD here.

===========================================================

Update: 13-08-2018

Received emails from lot of members requesting for code of this EA. Here you go friends; make experiment with it and do share good results in case you find better setting, add some better engine to improve profitability and to reduce DD. Thanks

===========================================================

Update: 11-10-2018

===========================================================

Update: 15-11-2018

I believe 6 months demo testing is enough to reveal the bugs and loop holes of this version. I have stopped my demo VPS account because needed the slot for testing of some other EA.

===========================================================

Update: 12-09-2019

I tried this EA on Real Cent account for a week and came to know that this EA is not working as per given strategy (excel sheet) and it was really badly coded. So I would not recommend any one to use this on real account.

===========================================================

Update: 16-05-2020

Most of the users were not able to change expiry date in mq4 file, so I uploaded a revised file with expiry date 31-12-2040.

Attached File(s)

Grid / Martingale / Hedge Lover