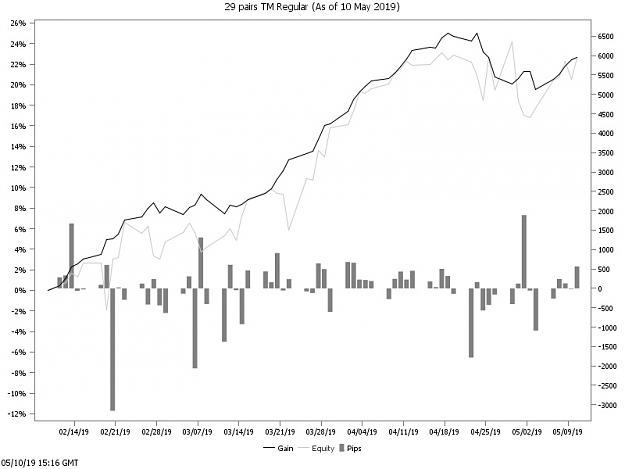

For those who have been in the markets the past few months may have experienced lower volatility in April, given the bank holidays and the Golden Week in Japan.

I have seen many accounts make substantial losses in the month of April. It really is a test of the robustness of your strategy in times like this. And these are times that remind you the need for diversification.

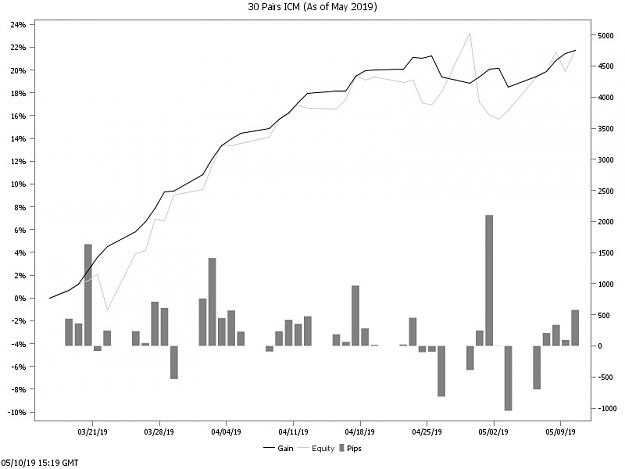

See the dip in near the middle of April. It is noticeable. Without diversification I would not have maintained my equity line as much as I would want to.

I have seen many accounts make substantial losses in the month of April. It really is a test of the robustness of your strategy in times like this. And these are times that remind you the need for diversification.

See the dip in near the middle of April. It is noticeable. Without diversification I would not have maintained my equity line as much as I would want to.

1