Starting to make the transition to trading off the daily, the time has come. Have tired of the intraday crap and am liking spending less time in front of the screen. Not to mention these damn screens have blinded me. Less is more, I've been saying it for years, now actually starting to see that its true, at least for me.

Anyway, this is a spot to post your daily levels, ideas, observations. I know people post them elsewhere, but you have to sift through a gazillion short term charts most times.

By no means do I suggest, or subscribe to the idea that trading off the daily is better than any other time frame. Nor do I scoff at those who chose to trade short term. The daily is just as big a pain in the ass. Just that there are less trades to get involved in, and that, for the moment makes me happy.

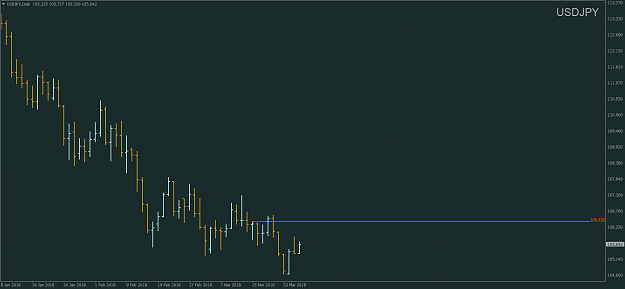

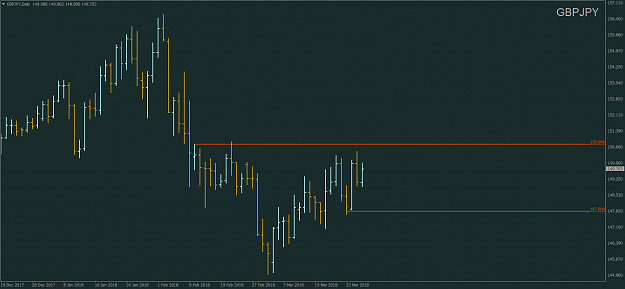

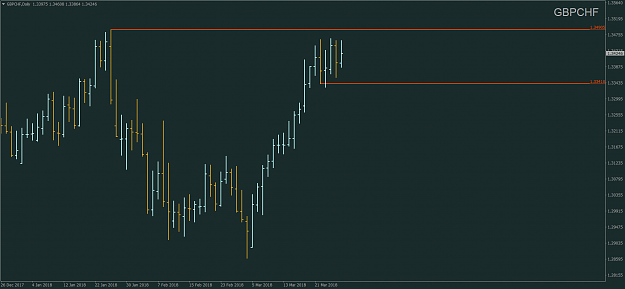

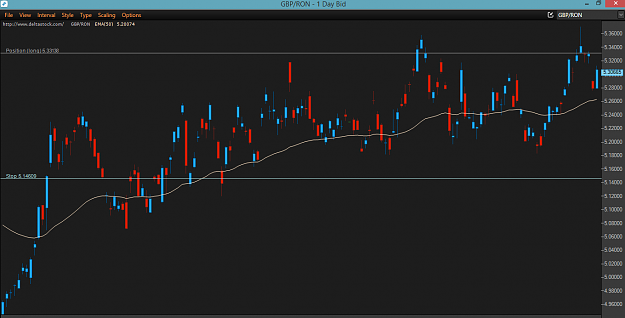

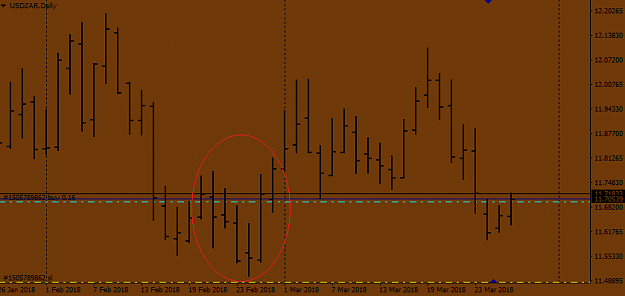

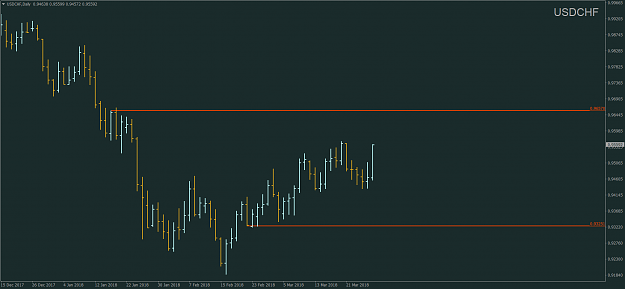

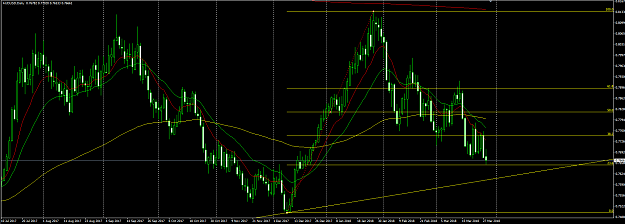

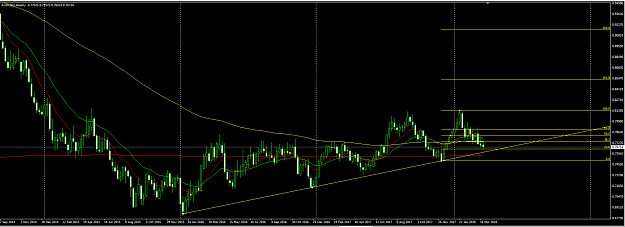

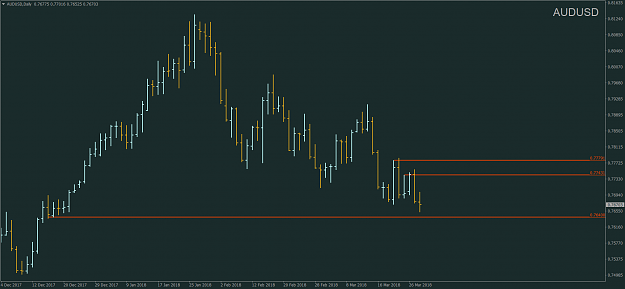

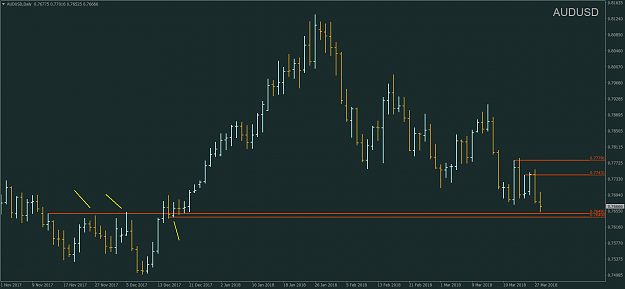

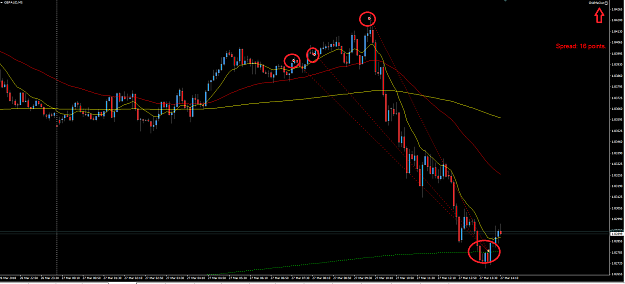

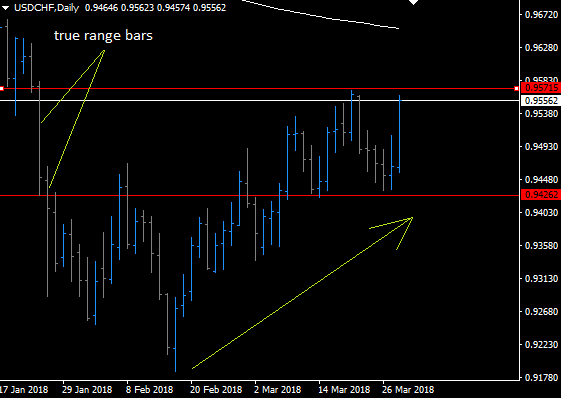

So, lets keep it simple. Daily charts, ONLY.(Weekly and Monthly appreciated also) A couple of spots your looking at, or considering doing something, and that's it. No need for all the gory details. No need to follow up on what the hell you did, or didn't.

Anyway, this is a spot to post your daily levels, ideas, observations. I know people post them elsewhere, but you have to sift through a gazillion short term charts most times.

By no means do I suggest, or subscribe to the idea that trading off the daily is better than any other time frame. Nor do I scoff at those who chose to trade short term. The daily is just as big a pain in the ass. Just that there are less trades to get involved in, and that, for the moment makes me happy.

So, lets keep it simple. Daily charts, ONLY.(Weekly and Monthly appreciated also) A couple of spots your looking at, or considering doing something, and that's it. No need for all the gory details. No need to follow up on what the hell you did, or didn't.

Look Sharp/Trade Tight