Starting this thread to note down my plan to use EA portfolio for retirement target to retire by age 50 (5 years early than general retirement age of 55). Why I am intending to use EA for trading instead of manual trading. Firstly, i have family commitment and would like to spend the time with my family after the full day working. Secondly, can get rid away of greed, fear and negative emotions during trading. Although I admit that some manual trading is better performance than EA trading, because EA has to be precise and systematic. However, I am willing to compromise the return.

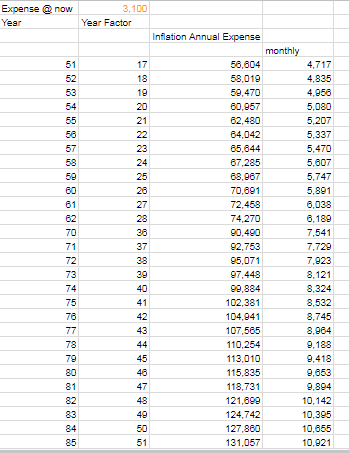

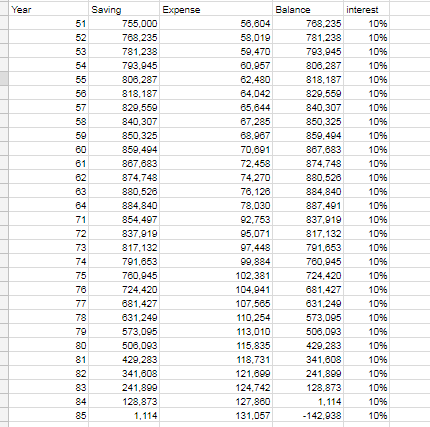

I am aim for 10% return consistently per year and with minimal drawdown. I like to do financial planning for myself especially for my retirement, this is very important especially in competitive environment in Singapore. Mid-life career crisis (45-55) is pretty normal. Although I have been experience 2 big losses in forex trading, but I have faith and confidence to treat forex as business, can even then pass to my daughter for her future wealth creation. What I plan is I'll put up a capital every year (about $28k) with the expected return of 10% per year, which I think is reasonable in forex trading world, together with compounded return and no withdrawal, then amount will reach about $755k at age 51. This amount can sustain my wife and myself with about $3k per month expense from age 51 to 85.

I have a strategy have been using few years ago, and the slightly more than usual drawdown and consecutive losses (>10) which make me think its not working anymore. I restarted again last July and code it myself into EA, and continue to backtest back to where I stop trading. 2015 marks +40%, 2016 marks +3% (which I stop trading somewhere in June) and 2017 marks 38.4% (which I restart in July), the number consists both back-tests and live trading. (Guess some of you will think only 3 years of back-test is sufficient? I don't wish to argue this topic over this thread).

For the above EA, I have no clue when should I stop trading for that year at which drawdown level, although I know my EA has only 38% win ratio and reward: risk ratio is 2:1. I have checked some websites about the relationship between 38% win ratio and drawdown level (from highest level), it stated can be as high as 25%. And then I keep thinking surround this challenge e.g. what happen if I only hit this issue only in my retirement age and I am depending solely on this EA to generate income for me. Suddenly few days ago, I got the "AHA" moment after keep reading books which relate to trading, investment and retirement, and I can achieve the retirement wish with list of different style of EAs to form a EA portfolio.

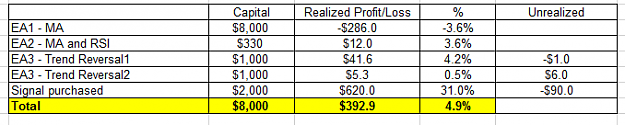

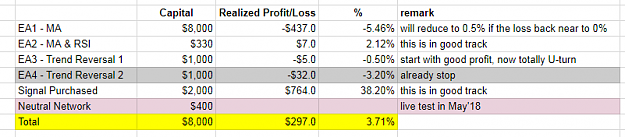

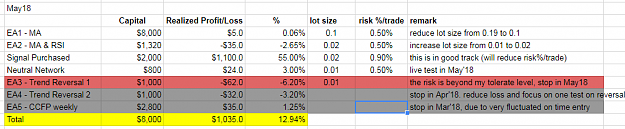

This is how it works. Assuming I have 5 EAs comprises of different strategy and $20k at the beginning of the year. I'll allocate 20% ($4k) for each EAs, usually I will open sub-account under same broker to better manage and track, journal and monitor the performance of each EA. And I have also set the stop-trading trigger point where the cumulative loss of the particular EA hit 10% of beginning capital of $20k, which is $2k. As the 5 EAs comprises of different strategy, likelihood of all EAs hitting the stop-trading trigger point is quite low. The criteria of selecting the EA into the portfolio must at least hit 10% return and highest loss from the backtest didn't more than 10%. So if 3 out of EAs able to meet the minimum of 10% return per year, then it's able to meet the requirement of generate 10% return per year at portfolio level.

Besides the first EA I mentioned above, I also started live trading small on CCFp EA (thanks to @forexpinbar and @Xmess), you can find out more from below:

https://www.forexfactory.com/showthread.php?t=635569

As the trade is based on weekly basket trading, will confirm to put this EA under my EA portfolio, will confirm after 6 months of forward testing. Will update on weekly basis about this strategy.

At the same time, will continue to look for other 3 profitable strategies and EAs. If anyone of you have the similar mindset like mine, welcome you to join my thread, and we can grow together.

I am aim for 10% return consistently per year and with minimal drawdown. I like to do financial planning for myself especially for my retirement, this is very important especially in competitive environment in Singapore. Mid-life career crisis (45-55) is pretty normal. Although I have been experience 2 big losses in forex trading, but I have faith and confidence to treat forex as business, can even then pass to my daughter for her future wealth creation. What I plan is I'll put up a capital every year (about $28k) with the expected return of 10% per year, which I think is reasonable in forex trading world, together with compounded return and no withdrawal, then amount will reach about $755k at age 51. This amount can sustain my wife and myself with about $3k per month expense from age 51 to 85.

I have a strategy have been using few years ago, and the slightly more than usual drawdown and consecutive losses (>10) which make me think its not working anymore. I restarted again last July and code it myself into EA, and continue to backtest back to where I stop trading. 2015 marks +40%, 2016 marks +3% (which I stop trading somewhere in June) and 2017 marks 38.4% (which I restart in July), the number consists both back-tests and live trading. (Guess some of you will think only 3 years of back-test is sufficient? I don't wish to argue this topic over this thread).

For the above EA, I have no clue when should I stop trading for that year at which drawdown level, although I know my EA has only 38% win ratio and reward: risk ratio is 2:1. I have checked some websites about the relationship between 38% win ratio and drawdown level (from highest level), it stated can be as high as 25%. And then I keep thinking surround this challenge e.g. what happen if I only hit this issue only in my retirement age and I am depending solely on this EA to generate income for me. Suddenly few days ago, I got the "AHA" moment after keep reading books which relate to trading, investment and retirement, and I can achieve the retirement wish with list of different style of EAs to form a EA portfolio.

This is how it works. Assuming I have 5 EAs comprises of different strategy and $20k at the beginning of the year. I'll allocate 20% ($4k) for each EAs, usually I will open sub-account under same broker to better manage and track, journal and monitor the performance of each EA. And I have also set the stop-trading trigger point where the cumulative loss of the particular EA hit 10% of beginning capital of $20k, which is $2k. As the 5 EAs comprises of different strategy, likelihood of all EAs hitting the stop-trading trigger point is quite low. The criteria of selecting the EA into the portfolio must at least hit 10% return and highest loss from the backtest didn't more than 10%. So if 3 out of EAs able to meet the minimum of 10% return per year, then it's able to meet the requirement of generate 10% return per year at portfolio level.

Besides the first EA I mentioned above, I also started live trading small on CCFp EA (thanks to @forexpinbar and @Xmess), you can find out more from below:

https://www.forexfactory.com/showthread.php?t=635569

As the trade is based on weekly basket trading, will confirm to put this EA under my EA portfolio, will confirm after 6 months of forward testing. Will update on weekly basis about this strategy.

At the same time, will continue to look for other 3 profitable strategies and EAs. If anyone of you have the similar mindset like mine, welcome you to join my thread, and we can grow together.