1. My beliefs, my emotions, my psychology

Why you are trading?

Trading is a business, treat it like a business. Treat it with respect, patience and discipline.

Forget trading. You are INVESTING. You are INVESTING in the rest of your life. You have many years to INVEST, there is no need to RUSH and try and do it all in one day. RELAX, slow down and let the stress and pressure of wanting to make money float away. Take one step at a time. Rome wasn't built in a day.

The sooner you realise you can ONLY trade what the market gives you and NOTHING more, the better trader you will become.

When we are trading to live, we look at the charts for opportunities. We do NOT go looking for trades. The good opportunities will stand out like a sore thumb.

The more you are under pressure (stress), the more mistakes you will make and the more you will lose. Just relax, trade what you see, not what you think.

You need confidence in trading so you do whatever you have to do to take the trade. How can you learn to swim if you never get your feet wet?

"Hope" is not a pre-requisite for successful trading so get that out of your head.

I knew my performance was dictated and controlled by my fear and greed emotions. I knew I had to draw up hard and fast rules for myself when trading to counteract my gremlins and demons who always talked me out of doing the "right" thing. Out of this evolved my PLAN which works and continues to work for me and works for others.

Success comes in CANS not cannots.

2. PLAN the trade, trade the PLAN

NEVER trade without a PLAN and NEVER trade on a whim and NEVER, EVER hopt that a trade will turn arount for you.

Your PLAN should be RIGID on your SL - set this in concrete and don't move it no matter what happens.

Until you can trust, believe and accept your PLAN and stick with it no matter what happens, your PLAN is not worth the papper it is written on.

Some of you are still struggling with your PLAN, specifically interfering with your PLAN during a trade. Again, this is trading with your EMOTIONS instead of with DISCIPLINE.

3. Risk Management

Remember, the FIRST thing you should think about when taking a trade is HOW MUCH WILL I LOSE?

The hardest and most painful aspect of trading whether we are beginners or professionals is to not only accept losses but also to take our losses. PLAN for the losses and TAKE the losses WITHOUT QUESTION. Losses are an integral part of trading and, planning for them, accepting them, and taking them, will go a long way to making you a much better, successful and profitable trader.

While your SL should be rigid, your profit target should be FLEXIBLE.

LEARN how to deal with LOSING because WE ALL LOSE - LEARN how to keep your LOSING trades SMALLER than your winning trades.

Ensure you ALWAYS think about how much you will LOSE, rather than how much you will win when planning a trade. The winners take care of themselves but WE have to control the losers and ensure they are ALWAYS smaller than our winners. Accept that YOU WILL LOSE - losing is part of doing trading business - learn to accept the loss; don't fight it or tear yourself up because you got it wrong. We are neither right or wrong, only winners and losers. The market is ALWAYS right.

Within all this, learn PATIENCE & DISCIPLINE. Learn to wait for the right opportunities to present themselves.

PATIENCE & DISCIPLINE is our biggest challenge especially in times like this where prices are range bound and trendless.

4. The Power of Time Frame

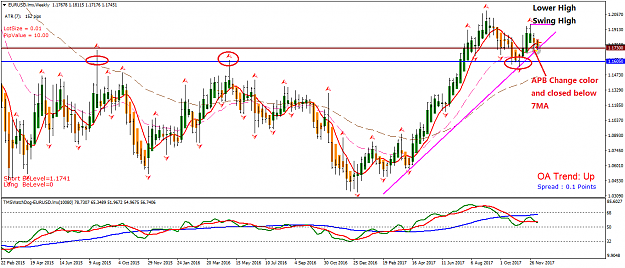

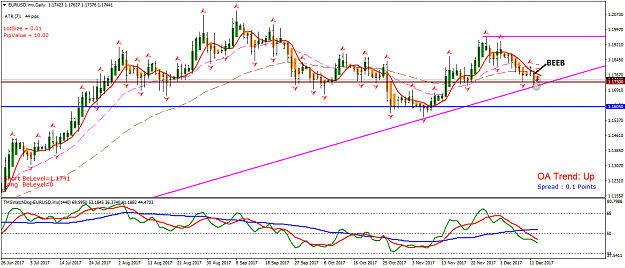

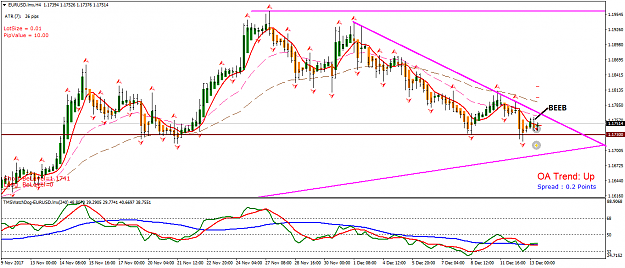

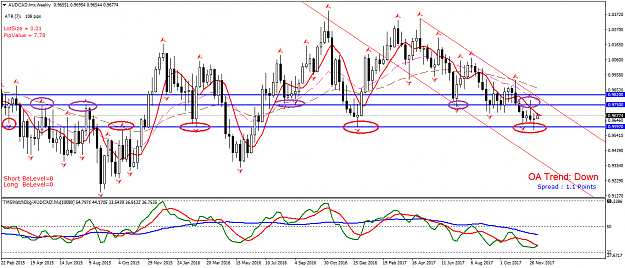

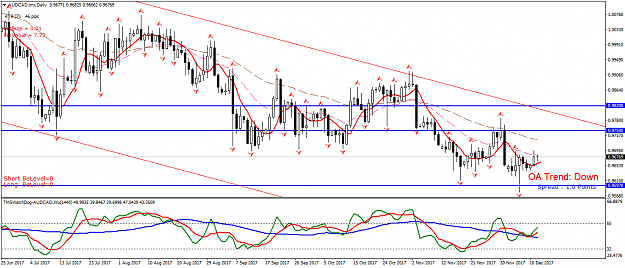

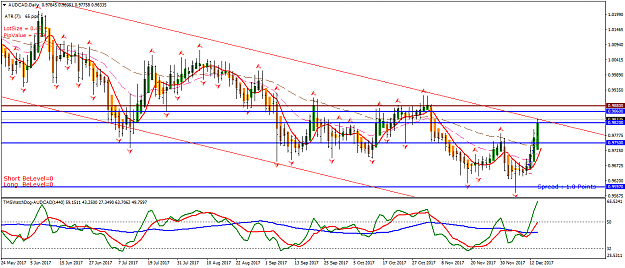

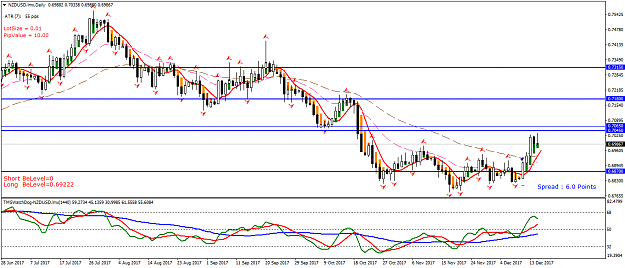

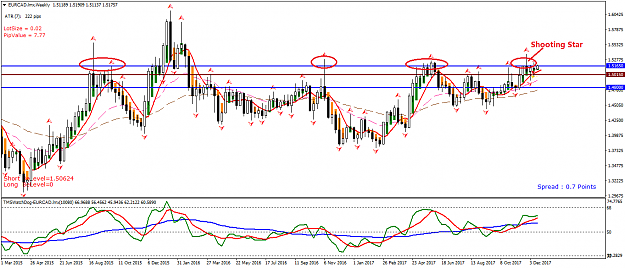

PASR is a 3 time frame strategy using the Power of Time Frame.

RESIST, at all times, the temptation to go "looking for action" on shorter time frames when there is no action on the daily charts. Understand that we do not predict the market; we react to the market; we let it show us the way and then we follow.

5. TREND, TREND, TREND

6. PASR

We draw our S&R FIRST, then we look for PRICE ACTION at our already drawn and waiting S&R.

Disclaimer:

Any trade or analysis related comments made in this thread by myself or any other person on this thread should not be interpreted as anything other than a point of view by the respective poster and not as advice to enter or exit a trade.

Why you are trading?

Trading is a business, treat it like a business. Treat it with respect, patience and discipline.

Forget trading. You are INVESTING. You are INVESTING in the rest of your life. You have many years to INVEST, there is no need to RUSH and try and do it all in one day. RELAX, slow down and let the stress and pressure of wanting to make money float away. Take one step at a time. Rome wasn't built in a day.

The sooner you realise you can ONLY trade what the market gives you and NOTHING more, the better trader you will become.

When we are trading to live, we look at the charts for opportunities. We do NOT go looking for trades. The good opportunities will stand out like a sore thumb.

The more you are under pressure (stress), the more mistakes you will make and the more you will lose. Just relax, trade what you see, not what you think.

You need confidence in trading so you do whatever you have to do to take the trade. How can you learn to swim if you never get your feet wet?

"Hope" is not a pre-requisite for successful trading so get that out of your head.

I knew my performance was dictated and controlled by my fear and greed emotions. I knew I had to draw up hard and fast rules for myself when trading to counteract my gremlins and demons who always talked me out of doing the "right" thing. Out of this evolved my PLAN which works and continues to work for me and works for others.

Success comes in CANS not cannots.

2. PLAN the trade, trade the PLAN

NEVER trade without a PLAN and NEVER trade on a whim and NEVER, EVER hopt that a trade will turn arount for you.

Your PLAN should be RIGID on your SL - set this in concrete and don't move it no matter what happens.

Until you can trust, believe and accept your PLAN and stick with it no matter what happens, your PLAN is not worth the papper it is written on.

Some of you are still struggling with your PLAN, specifically interfering with your PLAN during a trade. Again, this is trading with your EMOTIONS instead of with DISCIPLINE.

3. Risk Management

Remember, the FIRST thing you should think about when taking a trade is HOW MUCH WILL I LOSE?

The hardest and most painful aspect of trading whether we are beginners or professionals is to not only accept losses but also to take our losses. PLAN for the losses and TAKE the losses WITHOUT QUESTION. Losses are an integral part of trading and, planning for them, accepting them, and taking them, will go a long way to making you a much better, successful and profitable trader.

While your SL should be rigid, your profit target should be FLEXIBLE.

LEARN how to deal with LOSING because WE ALL LOSE - LEARN how to keep your LOSING trades SMALLER than your winning trades.

Ensure you ALWAYS think about how much you will LOSE, rather than how much you will win when planning a trade. The winners take care of themselves but WE have to control the losers and ensure they are ALWAYS smaller than our winners. Accept that YOU WILL LOSE - losing is part of doing trading business - learn to accept the loss; don't fight it or tear yourself up because you got it wrong. We are neither right or wrong, only winners and losers. The market is ALWAYS right.

Within all this, learn PATIENCE & DISCIPLINE. Learn to wait for the right opportunities to present themselves.

PATIENCE & DISCIPLINE is our biggest challenge especially in times like this where prices are range bound and trendless.

4. The Power of Time Frame

PASR is a 3 time frame strategy using the Power of Time Frame.

RESIST, at all times, the temptation to go "looking for action" on shorter time frames when there is no action on the daily charts. Understand that we do not predict the market; we react to the market; we let it show us the way and then we follow.

5. TREND, TREND, TREND

6. PASR

We draw our S&R FIRST, then we look for PRICE ACTION at our already drawn and waiting S&R.

Disclaimer:

Any trade or analysis related comments made in this thread by myself or any other person on this thread should not be interpreted as anything other than a point of view by the respective poster and not as advice to enter or exit a trade.

Keep DISCIPLINE, control RISKS, and don't destroy your DREAM easily.