All reversal times are forecasted based on Eastern Time.

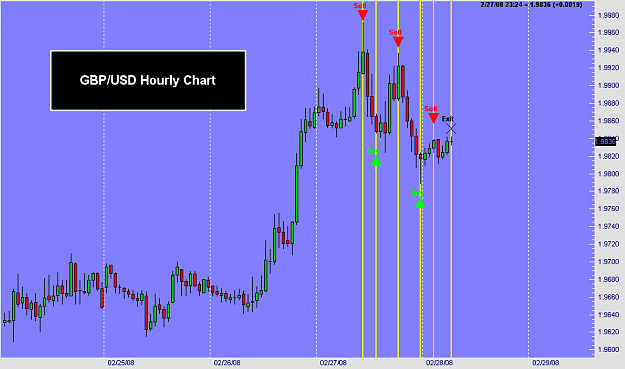

GBP/USD Reversals for 2/27/08

Daily

2/25/08-high expected

3/03/08-low expected

3/10/08-high expected

Hourly

3:00-4:00(2/27/08)

6:00-7:00

11:00-12:00

16:00-17:00*

19:00-20:00*

23:00-0:00*

AUD/USD Reversals for 2/27/08

Daily

2/21/08-high expected

2/26/08-high expected

3/04/08-low expected

Hourly

3:00-4:00(2/27/08)

6:00-7:00

9:00-10:00

13:00-14:00

16:00-17:00*

19:00-20:00*

USD/CAD Reversals for 2/27/08

Daily

2/25/08-low expected

2/28/08-low expected

3/05/08-high expected

Hourly

1:00-2:00(2/27/08)

6:00-7:00

10:00-11:00

14:00-15:00*

18:00-19:00*

22:00-23:00*

USD/JPY Reversals for 2/27/08

Daily

2/20/08-high expected

2/26/08-low expected

3/04/08-high expected

Hourly

1:00-2:00(2/27/08)

4:00-5:00

7:00-8:00

10:00-11:00*

14:00-15:00*

18:00-19:00*

20:00-21:00*

GBP/EUR Reversals for 2/27/08

Daily

2/21/08-low expected

2/27/08-high expected

3/03/08-low expected

Hourly

1:00-2:00(2/27/08)

6:00-7:00

9:00-10:00

13:00-14:00

16:00-17:00*

23:00-0:00*

EUR/USD Reversals for 2/27/08

Daily

2/25/08-high expected

2/29/08-low expected

3/06/08-high expected

Hourly

1:00-2:00(2/27/08)

4:00-5:00

9:00-10:00

14:00-15:00*

18:00-19:00*

22:00-23:00*

NZD/USD Reversals for 2/27/08

Daily

2/21/08-high expected

2/28/08-high expected

3/05/08-low expected

Hourly

2:00-3:00(2/27/08)

6:00-7:00

9:00-10:00

12:00-13:00

14:00-15:00*

17:00-18:00*

23:00-0:00*

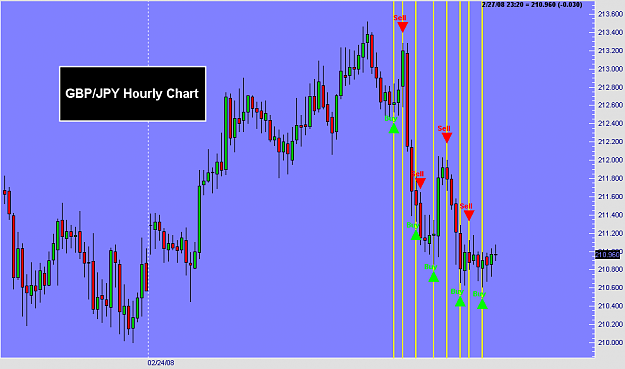

GBP/JPY Reversals for 2/27/08

Daily

2/25/08-high expected

2/28/08-low expected

3/03/08-high expected

Hourly

0:00-1:00(2/27/08)

2:00-3:00

5:00-6:00

9:00-10:00

12:00-13:00

15:00-16:00*

17:00-18:00*

20:00-21:00*

GBP/USD Reversals for 2/27/08

Daily

2/25/08-high expected

3/03/08-low expected

3/10/08-high expected

Hourly

3:00-4:00(2/27/08)

6:00-7:00

11:00-12:00

16:00-17:00*

19:00-20:00*

23:00-0:00*

AUD/USD Reversals for 2/27/08

Daily

2/21/08-high expected

2/26/08-high expected

3/04/08-low expected

Hourly

3:00-4:00(2/27/08)

6:00-7:00

9:00-10:00

13:00-14:00

16:00-17:00*

19:00-20:00*

USD/CAD Reversals for 2/27/08

Daily

2/25/08-low expected

2/28/08-low expected

3/05/08-high expected

Hourly

1:00-2:00(2/27/08)

6:00-7:00

10:00-11:00

14:00-15:00*

18:00-19:00*

22:00-23:00*

USD/JPY Reversals for 2/27/08

Daily

2/20/08-high expected

2/26/08-low expected

3/04/08-high expected

Hourly

1:00-2:00(2/27/08)

4:00-5:00

7:00-8:00

10:00-11:00*

14:00-15:00*

18:00-19:00*

20:00-21:00*

GBP/EUR Reversals for 2/27/08

Daily

2/21/08-low expected

2/27/08-high expected

3/03/08-low expected

Hourly

1:00-2:00(2/27/08)

6:00-7:00

9:00-10:00

13:00-14:00

16:00-17:00*

23:00-0:00*

EUR/USD Reversals for 2/27/08

Daily

2/25/08-high expected

2/29/08-low expected

3/06/08-high expected

Hourly

1:00-2:00(2/27/08)

4:00-5:00

9:00-10:00

14:00-15:00*

18:00-19:00*

22:00-23:00*

NZD/USD Reversals for 2/27/08

Daily

2/21/08-high expected

2/28/08-high expected

3/05/08-low expected

Hourly

2:00-3:00(2/27/08)

6:00-7:00

9:00-10:00

12:00-13:00

14:00-15:00*

17:00-18:00*

23:00-0:00*

GBP/JPY Reversals for 2/27/08

Daily

2/25/08-high expected

2/28/08-low expected

3/03/08-high expected

Hourly

0:00-1:00(2/27/08)

2:00-3:00

5:00-6:00

9:00-10:00

12:00-13:00

15:00-16:00*

17:00-18:00*

20:00-21:00*